Human-in-the-Loop (HITL) governance combines human oversight with automated systems to manage treasury operations more effectively. This approach is particularly relevant for stablecoins, where transactions are fast but irreversible. HITL governance ensures real-time validation, compliance, and error prevention before transactions are finalized on the blockchain.

Key Takeaways:

What it is: A balance of automation and human control in treasury workflows.

Why it matters: Stablecoins processed an estimated $1.3 trillion in 2024, but their speed and irreversibility make errors costly.

How it works: Pre-signature controls verify payments against rules before execution, ensuring compliance with regulations like the GENIUS Act.

Benefits: Combines speed and cost-efficiency of automation with human oversight to prevent fraud and ensure compliance.

HITL governance is essential for managing the risks and complexities of blockchain-based treasury operations while maintaining regulatory standards.

Humans in the Loop: A Framework for Leaders

Core Concepts and Features of HITL Governance

Manual vs Automated vs HITL Treasury Governance Comparison

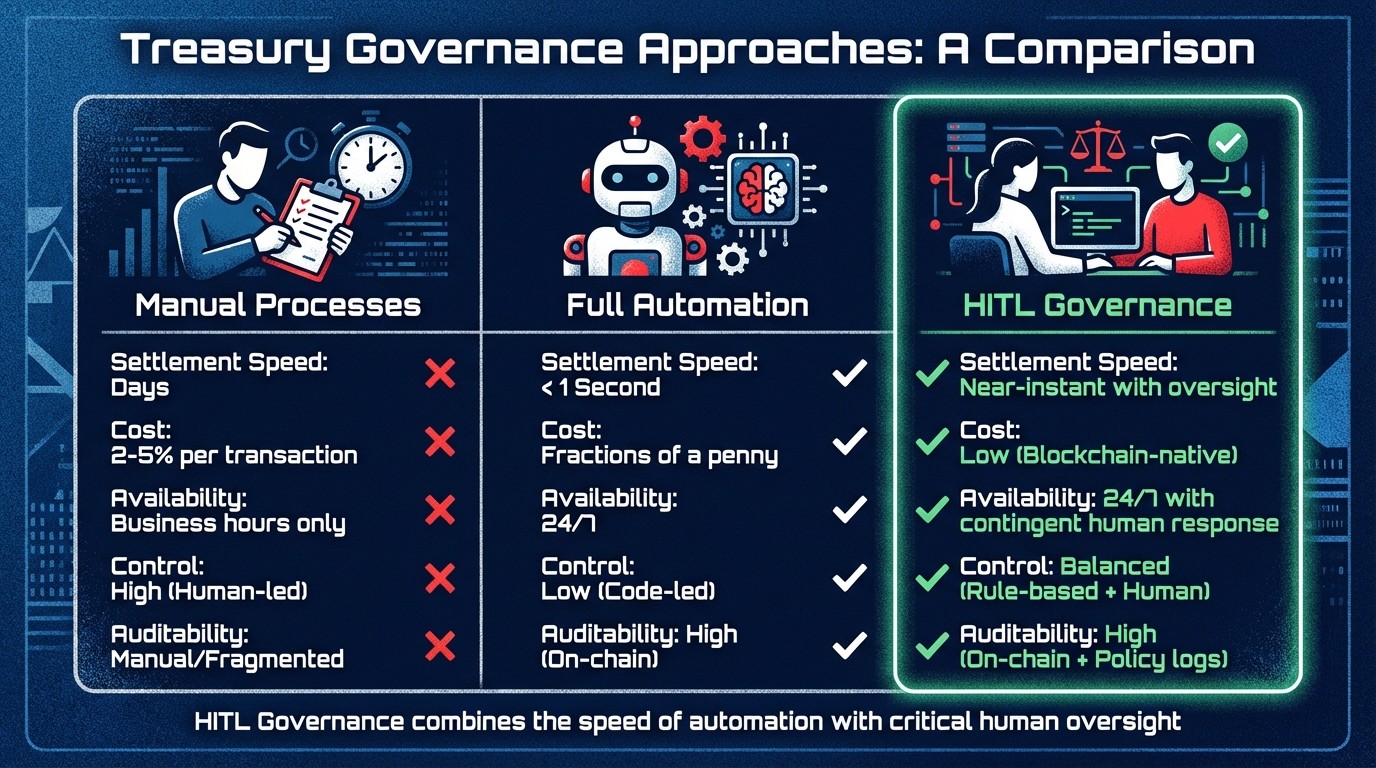

HITL vs. Full Automation vs. Manual Processes

Human-in-the-Loop (HITL) governance bridges the gap between two extremes: manual processes and full automation. Manual treasury operations are often slow and expensive, with transaction costs ranging from 2–5% and settlement times stretching over several days - making 24/7 functionality nearly impossible. On the other hand, full automation provides lightning-fast execution on blockchain networks like Solana, where transactions settle in under a second and costs drop dramatically. For instance, on a network processing 400 billion transactions annually, fee revenue could shrink to approximately $400 million - a staggering 99% reduction in costs. However, fully automated systems often lack the nuanced oversight needed to handle complex operations involving multiple geographies, currencies, and accounts.

HITL governance strikes a balance by combining the efficiency of automation with critical human oversight. As Foundation Capital puts it:

"Governance, Risk and Compliance playbooks are built directly into protocols, providing real-time, rule-based risk and compliance monitoring for on-chain transactions".

Here’s a quick comparison of these approaches:

Feature | Manual Processes | Full Automation | HITL Governance |

|---|---|---|---|

Settlement Speed | Days | < 1 Second | Near-instant with oversight |

Cost | 2–5% per transaction | Fractions of a penny | Low (Blockchain-native) |

Availability | Business hours | 24/7 | 24/7 with contingent human response |

Control | High (Human-led) | Low (Code-led) | Balanced (Rule-based + Human) |

Auditability | Manual/Fragmented | High (On-chain) | High (On-chain + Policy logs) |

This blend of speed, cost savings, and oversight lays the groundwork for robust pre-signature controls in stablecoin workflows.

Pre-Signature Controls in Stablecoin Workflows

Pre-signature controls serve as a vital checkpoint, ensuring that transaction intents align with established policies - like asset eligibility, reserve requirements, and redemption rules - before cryptographic signatures authorize fund movement. This layer of verification is crucial for regulatory compliance. For example, the New York Department of Financial Services (NY DFS) requires stablecoin issuers to maintain "clear, conspicuous redemption policies" that guarantee lawful holders can redeem units "in a timely fashion at par." In this case, "timely" means within two full business days (T+2) after receiving a compliant order.

By embedding these controls into workflows, organizations can reduce fraud risks, maintain AML/BSA compliance, and protect reserve assets through human oversight. These processes also set the stage for a more advanced approach: Policy-as-Code.

Policy-as-Code in HITL Governance

Policy-as-Code takes treasury policies - like transaction limits, role-based permissions, and asset restrictions - and translates them into machine-readable rules. These rules are automatically enforced as payments are initiated, stopping fraud or policy violations before they happen. One practical example is the concept of "Policy Cages", which are immutable smart contract rules that strictly define what assets can be managed, which protocols can be used, and the maximum risk levels allowed. In December 2025, Theoriq implemented a governance model using Policy Cages to ensure autonomous AI agents adhered to regulatory requirements, eliminating the need for human intervention in every transaction.

Modern treasury platforms make this process more accessible by offering low-code tools for creating custom payment rules and approval workflows. These tools also ensure stability during system upgrades. As Dory Malouf, Senior Director of Global Value Engineering, explains:

"Controls must live inside the flow of work... Screenings, validations, and exposure checks must run while the payment is being created, not days or weeks after the fact".

While Policy-as-Code automates routine tasks - such as reconciliation and compliance screening - it doesn’t replace human oversight. Instead, it allows treasury teams to focus on more critical decisions, leaving repetitive tasks to AI.

How to Implement HITL Governance in Stablecoin Treasury

Where HITL Controls Fit in the Stablecoin Stack

Human-In-The-Loop (HITL) governance acts as a policy-driven control layer that operates above custody infrastructure. Its primary role is to verify payment requests against established company policies before granting authorization.

At the core of this setup is Multi-Party Computation (MPC). With MPC, no single individual has access to a complete private key. Instead, executing a transaction requires a quorum of signers, reducing the risk of single points of failure while maintaining blockchain efficiency. The control layer plays a pivotal role by intercepting transaction requests, conducting compliance checks, enforcing approval hierarchies, and forwarding approved transactions for signing.

This proactive approach shifts the focus from reactive monitoring - catching issues after funds have moved - to preventing unauthorized transactions before they occur. Colin Swain, Global Head of Product at Bottomline, emphasizes this proactive stance:

"One of the core defenses is for corporates to be entirely clear about who they're paying, and who they're being paid by".

This foundational control layer is essential for ensuring detailed oversight through advanced technology platforms.

How Stablerail Supports HITL Governance

Stablerail functions as a control system positioned at the pre-signature stage. It conducts automated checks, such as sanctions screening, counterparty risk analysis, enforcement of policy limits, and detection of unusual behaviors - all before a transaction is signed. Unlike fully automated systems, Stablerail keeps humans involved by offering clear, actionable insights for every flagged transaction.

For instance, if a payment request raises concerns, Stablerail doesn’t simply block it with an ambiguous error message. Instead, it generates a Risk Dossier that explains the issue in detail. This dossier highlights specific policy clauses, timestamps, and risk factors, helping treasury teams make informed decisions that can withstand audits or regulatory reviews.

Additionally, Stablerail integrates with blockchain intelligence tools like Chainalysis and TRM Labs, enabling real-time transaction screening.

Designing Policies for HITL Stablecoin Controls

Effective policies are the backbone of HITL governance, striking a balance between automation and human oversight. These policies should begin with a board-approved treasury framework that outlines permissible assets, use cases, transaction venues, and prohibited activities. From there, the challenge is to convert these high-level principles into machine-enforceable rules.

Start by defining clear approval hierarchies and transaction thresholds. For example, Utila’s MPC-based platform allows treasury teams to set rules requiring both the CFO and COO to approve transactions exceeding a certain amount via a mobile signing app. You could create policies like:

"Payments to new addresses over $5,000 require CFO approval and counterparty verification."

"Weekend transfers above $10,000 need additional approval."

Another key element is implementing asset allowlists. By restricting transfers to pre-approved, vetted counterparty addresses, you can significantly reduce the risk of unauthorized transactions. Wallet tiering strategies are also useful. For instance, cold wallets holding long-term reserves might require multi-person signing ceremonies with robust physical security, while hot wallets used for smaller, automated transactions could operate under strict velocity limits and continuous monitoring.

Finally, ensure policies enforce segregation of duties. The person initiating a payment should not be the same person approving or signing it. This separation minimizes risks and adds an extra layer of accountability.

Risk and Assurance Considerations for HITL Governance

Reducing Operational and Fraud Risks

Blockchain payments are irreversible - once a transaction is signed, there’s no turning back. This makes Human-in-the-Loop (HITL) governance a crucial safeguard for stablecoin treasury management operations. In 2024, global cryptocurrency fraud hit $12.4 billion, while stablecoins processed an estimated $1.3 trillion in payments. Without controls in place before transactions are signed, treasury teams face risks from both unauthorized fraud (like account takeovers) and authorized fraud (such as impersonation or invoice scams).

HITL governance provides dual control and independent verification before funds are moved. For instance, if a payment request raises red flags for sanctions or unusual behavior, a human approver steps in to review the Risk Dossier. They decide whether to approve, override with justification, or block the transaction outright. This process prevents irreversible errors. As Ashley Lannquist from the Atlantic Council explains:

"The immediate and irrevocable nature of stablecoin... payments raises the risk of fraud. There is little time to pre-screen transactions or to block or reverse them after a mistake has been made".

Another concern is autonomous drift in AI-driven treasury systems. About 55% of AI use cases in financial services involve some level of automated decision-making, with a 50:50 split between semi-autonomous (HITL) and fully automated processes. Without human oversight, these systems could evolve in ways that prioritize objectives like profit maximization, potentially amplifying market volatility or straying from the organization’s goals. HITL oversight ensures AI decision-making aligns with company objectives. Sarah Breeden, Deputy Governor for Financial Stability at the Bank of England, highlights this issue:

"We need to be focused in particular on ensuring that managers of financial firms are able to understand and manage what their AI models are doing as they evolve autonomously beneath their feet".

HITL governance also reinforces senior management accountability by creating a traceable framework for decisions. For example, when a flagged transaction is deemed low-risk or a credit assessment is made, treasury teams can link the decision back to specific policies, timestamps, and risk factors. This is especially important for models that lack clear explainability.

Audit and Regulatory Requirements

In addition to addressing risks, HITL governance supports compliance with evolving regulations. The GENIUS Act, signed into law on July 18, 2025, classifies permitted payment stablecoin issuers as "financial institutions", subjecting them to federal AML, CFT, and economic sanctions requirements. The Act passed the Senate with a vote of 68 to 30 and the House with a vote of 308 to 122. For treasury teams using stablecoins, this means shifting from detecting issues after the fact to preventing them before transactions occur.

HITL controls play a key role in meeting these compliance demands. They ensure transfers are authorized, sanctions are screened, and beneficiaries are verified before broadcasting transactions to the blockchain. CEOs and CFOs of stablecoin issuers must personally certify the accuracy of monthly reserve reports for regulators, and treasury teams need similar documentation to back up their decisions during audits or reviews.

The Travel Rule (31 CFR § 1010.410(f)) requires financial institutions to collect and transmit originator and beneficiary data for transactions over $3,000. HITL governance systems address this by capturing and screening this information at the pre-signature stage. As Notabene explains:

"When correctly implemented through pre-transaction authorization, institutions gain the ability to screen both originators and beneficiaries... block transactions in real time before irreversible settlement, and maintain compliance".

Senior managers must also document the "reasonable steps" they take to oversee autonomous systems. This aligns with accountability frameworks like the UK’s Senior Managers and Certification Regime.

Metrics to Measure HITL Effectiveness

To gauge how well HITL governance is working, organizations need to track key performance indicators (KPIs). The focus should shift from detection metrics (like suspicious activity reports) to prevention metrics that measure how effectively the system blocks illicit transactions before they’re finalized. Key metrics include:

Pre-transaction authorization rate: Tracks the percentage of transactions that pass authorization checks before being broadcast to the blockchain. This reflects whether HITL controls are catching issues early.

Approval response times: Measures how quickly human approvers act on flagged transactions. Delays can slow operations, while overly quick approvals might indicate insufficient oversight.

Override and freeze action metrics: Examines how often automated flags are overridden by human approvers, whether overrides are justified and documented, and how many transactions are blocked in real time due to high-risk factors. High override rates may suggest overly strict policies, while undocumented overrides pose audit risks.

As Notabene suggests, focusing on pre-transaction authorization rates, response times, and freeze actions provides a clearer picture of HITL effectiveness than relying solely on SAR counts.

Treasury teams should also ensure their governance practices align with organizational risk appetites. Regular audits of automated treasury models are essential to confirm that their objectives haven’t drifted from original parameters. Additionally, any AI or automated system should provide decision-making outputs that are understandable to humans, reducing the risk of undetected errors in areas like credit or fraud scoring.

Conclusion and Key Takeaways

Balancing Automation with Human Oversight

The rapid growth in stablecoin circulation has spotlighted the need for a careful balance between automation and human oversight. Automation brings the advantage of 24/7 instant settlement, but the irreversible nature of blockchain transactions demands governance that includes a human touch.

This isn't a debate between speed and security - it’s about achieving both. As McKinsey puts it:

"Safekeeping requires care to protect private keys from theft. While many solutions offering secure digital asset custody exist, the biggest risk is compromise of the access point to such custody solutions".

Human-in-the-loop (HITL) governance bridges this gap, combining behavioral oversight with cryptographic security. It ensures that automated processes align with organizational risk thresholds and regulatory standards.

With the stablecoin market projected to hit $2 trillion in market capitalization by 2028, and regulatory frameworks increasingly emphasizing anti-money laundering (AML) and sanctions compliance, treasury teams face mounting pressure to adopt scalable governance solutions. HITL governance provides a way to meet these challenges - offering near-instant settlements while maintaining the critical human reviews necessary to avoid costly errors.

This governance model merges the efficiency of automation with the prudence of human oversight, creating a system that aligns operational goals with compliance requirements. The next step is to translate these principles into actionable strategies.

Steps to Implement HITL Governance

Putting HITL governance into practice requires a structured approach.

Start by following a stablecoin compliance checklist to align policies with regulatory expectations. Frameworks like the GENIUS Act and the Travel Rule provide clear guidance on pre-transaction authorization, sanctions screening, and beneficiary verification. Use these as a foundation to design workflows that prioritize prevention over detection.

Next, integrate advanced monitoring tools alongside human oversight. Real-time surveillance tools can give approvers the insights they need to make informed decisions. Consider leveraging MPC-based wallets with robust governance controls. Programmable controls can enforce spending limits and jurisdictional restrictions, while manual approvals remain in place for high-value or sensitive transactions.

Finally, track the right metrics to evaluate your governance framework. Focus on indicators like pre-transaction authorization rates, response times for approvals, and freeze action metrics. These provide a clearer picture than relying solely on suspicious activity reports. Regular audits of automated systems are crucial to ensure they stay aligned with organizational goals. As noted by the U.S. Treasury:

"Innovative tools are critical to advancing efforts to address illicit finance risks but can also present new resource burdens for financial institutions".

Carefully weighing the costs, privacy concerns, and cybersecurity risks of your governance tools will help ensure they provide a meaningful benefit to your organization. Balancing these elements is key to building a governance framework that is both effective and sustainable.

FAQs

How does Human-in-the-Loop governance enhance the security of stablecoin transactions?

Human-in-the-Loop governance boosts the security of stablecoin transactions by introducing a manual review step before transactions are finalized. This pre-signature process gives treasury teams the chance to catch potential errors, confirm regulatory compliance, and address operational risks that automated systems might miss.

By blending human oversight with automated controls, this method adds an extra layer of protection. It ensures that decisions are not only secure but also well-justified. This approach helps organizations stay compliant, avoid costly mistakes, and strengthen trust in their stablecoin operations.

How does Policy-as-Code integrate with Human-in-the-Loop (HITL) governance?

Currently, there isn’t detailed information available about how Policy-as-Code integrates with Human-in-the-Loop (HITL) governance in treasury operations. However, HITL governance generally focuses on blending human oversight with automated processes to ensure decisions are both secure and compliant.

Policy-as-Code involves embedding governance rules and policies directly into automated systems. This approach can complement HITL by offering a structured framework for validating decisions. Although specific applications in HITL governance for stablecoin transactions remain unclear, the concept aligns with the broader goals of minimizing errors, improving consistency, and ensuring compliance.

How can companies adopt Human-in-the-Loop (HITL) governance for treasury operations?

To put Human-in-the-Loop (HITL) governance into practice within treasury operations, companies can design workflows that require a human touch before stablecoin transactions are finalized. This might involve assigning team members to review each transaction, ensuring they align with regulations like AML (Anti-Money Laundering) and sanctions policies. Automated tools can also play a role by flagging any potential risks for further review.

In addition, implementing strong security measures is crucial. Features like multi-factor authentication and risk assessment tools can help protect transactions from threats. Regular audits of these processes add another layer of assurance, ensuring decisions are secure, compliant, and well-documented. By blending automation with human oversight, treasury teams can minimize errors, strengthen accountability, and uphold operational integrity.

Related Blog Posts

Ready to modernize your treasury security?

Latest posts

Explore more product news and best practices for using Stablerail.