Stablecoins make payments faster and cheaper but bring risks like sanctions violations due to their pseudonymous nature. Governments, like the U.S., enforce strict liability standards, meaning companies can face penalties even for unintentional violations. Screening wallet addresses, monitoring transactions in real-time, and tracing fund flows are essential steps to avoid these risks.

Key insights:

Strict Compliance: U.S. OFAC requires screening against sanctions lists like the SDN List.

Evasion Tactics: Bad actors use mixers, cross-chain swaps, and new wallets to bypass detection.

Tools & Processes: Blockchain analytics, automated screening, and policy enforcement are critical safeguards.

Without proper controls, stablecoin transactions can lead to severe fines, reputational damage, and loss of banking access.

Crypto Investigations Explained: Why Sanctions Evasion Is So Easy

Sanctions Lists and Regulations You Need to Know

Handling stablecoin payments means navigating a maze of sanctions regulations. Building on earlier discussions about on-chain transaction challenges, understanding sanctions lists is a must for establishing solid pre-transaction controls. Missing a sanctioned address can have serious consequences. The U.S. Office of Foreign Assets Control (OFAC) operates under a strict liability standard, meaning your company could face civil penalties even if you unknowingly violate sanctions. Knowing which lists to screen and how they work together is essential to staying compliant with both U.S. and EU regulations.

U.S. OFAC Sanctions and the SDN List

The Specially Designated Nationals (SDN) List is the cornerstone of U.S. sanctions compliance. Managed by OFAC, this list includes over 9,000 individuals and entities whose assets are blocked, and U.S. persons are generally prohibited from engaging with them. But the SDN List is just the beginning.

OFAC also maintains a Consolidated Sanctions List, which includes non-SDN targets like the Sectoral Sanctions Identifications List and the Foreign Sanctions Evaders List. These lists, combined with rules like the 50 Percent Rule - which blocks entities owned 50% or more by sanctioned persons - create a comprehensive framework for screening.

OFAC distinguishes between comprehensive sanctions and targeted sanctions. Comprehensive sanctions cover nearly all trade with specific regions, such as Cuba, Iran, North Korea, Syria, and parts of Ukraine (Crimea, Donetsk, and Luhansk). Targeted sanctions, on the other hand, focus on specific individuals or sectors. For stablecoin transactions, this means screening wallet addresses and implementing geolocation controls to block access from comprehensively sanctioned regions.

"OFAC sanctions compliance obligations apply equally to transactions involving virtual currencies and those involving traditional fiat currencies." – U.S. Department of the Treasury

A stark example of OFAC's focus on crypto came in September 2021, when it sanctioned the Russian exchange SUEX OTC for facilitating transactions tied to ransomware. Over 40% of SUEX’s transaction history was linked to illicit actors, showing that crypto businesses are firmly under OFAC's scrutiny.

EU Sanctions and International Compliance

The European Union enforces its sanctions through the EU Consolidated List, which targets specific individuals, groups, and entities under EU financial sanctions. While the EU and U.S. often align on major sanctions programs, their lists are not identical. Businesses operating across borders must screen against both sets of regulations to ensure compliance.

The EU is also advancing its regulatory framework for stablecoins. By 2026, the Markets in Crypto-Assets Regulation (MiCAR) will establish rules for stablecoin issuers, including obligations to manage sanctions risks within their ecosystems. European banks are already preparing to launch MiCAR-compliant euro stablecoins under this new regime.

However, U.S. and EU regulations can sometimes clash. A transaction that is legal under EU law may still violate U.S. sanctions if it involves U.S. persons or infrastructure. For instance, stablecoins like USDC or USDT - pegged to the U.S. dollar - may trigger U.S. compliance issues. In late 2020, a U.S.-based digital asset company settled with OFAC after processing transactions for users in Crimea, Cuba, and Iran. The company had tracked IP addresses for security but failed to use this data for sanctions screening, leading to violations.

Secondary Sanctions and Cross-Border Risks

Adding another layer of complexity, secondary sanctions extend U.S. enforcement beyond its borders. These sanctions target non-U.S. entities that engage in activities undermining U.S. foreign policy, even if those activities lack direct U.S. connections. For stablecoin businesses, this poses a significant risk. Facilitating transactions with sanctioned regimes could lead to being added to the SDN List or losing access to the U.S. financial system.

For example, in March 2020, OFAC sanctioned two Chinese nationals, Tian Yinyin and Li Jiadong, for laundering approximately $100 million in stolen cryptocurrency on behalf of North Korea. They used complex methods, including buying over $1 million in digital gift cards, to hide the funds’ origins.

Non-U.S. businesses aren’t off the hook either. They can face penalties for "causing" a U.S. person to violate sanctions or for actions that would be prohibited if carried out by a U.S. entity. For sanctions targeting regions like Cuba, Iran, and North Korea, prohibitions even extend to foreign entities owned or controlled by U.S. persons or financial institutions. This means companies outside the U.S. must tread carefully if they deal with dollar-pegged stablecoins or serve U.S. customers.

Stablecoin issuers are increasingly stepping up as gatekeepers, implementing measures to monitor and control sanctions risks within their platforms.

Sanction Type | Scope | Key Restriction |

|---|---|---|

Comprehensive | Geographic (e.g., Iran, North Korea) | Prohibits nearly all trade/transactions with the region |

List-Based (SDN) | Specific Individuals/Entities | Requires blocking all property and interests in property |

Sectoral | Specific Economic Sectors | Prohibits certain activities, like dealing in debt or equity |

Secondary | Non-U.S. Persons | Threatens U.S. market access for dealing with sanctioned entities |

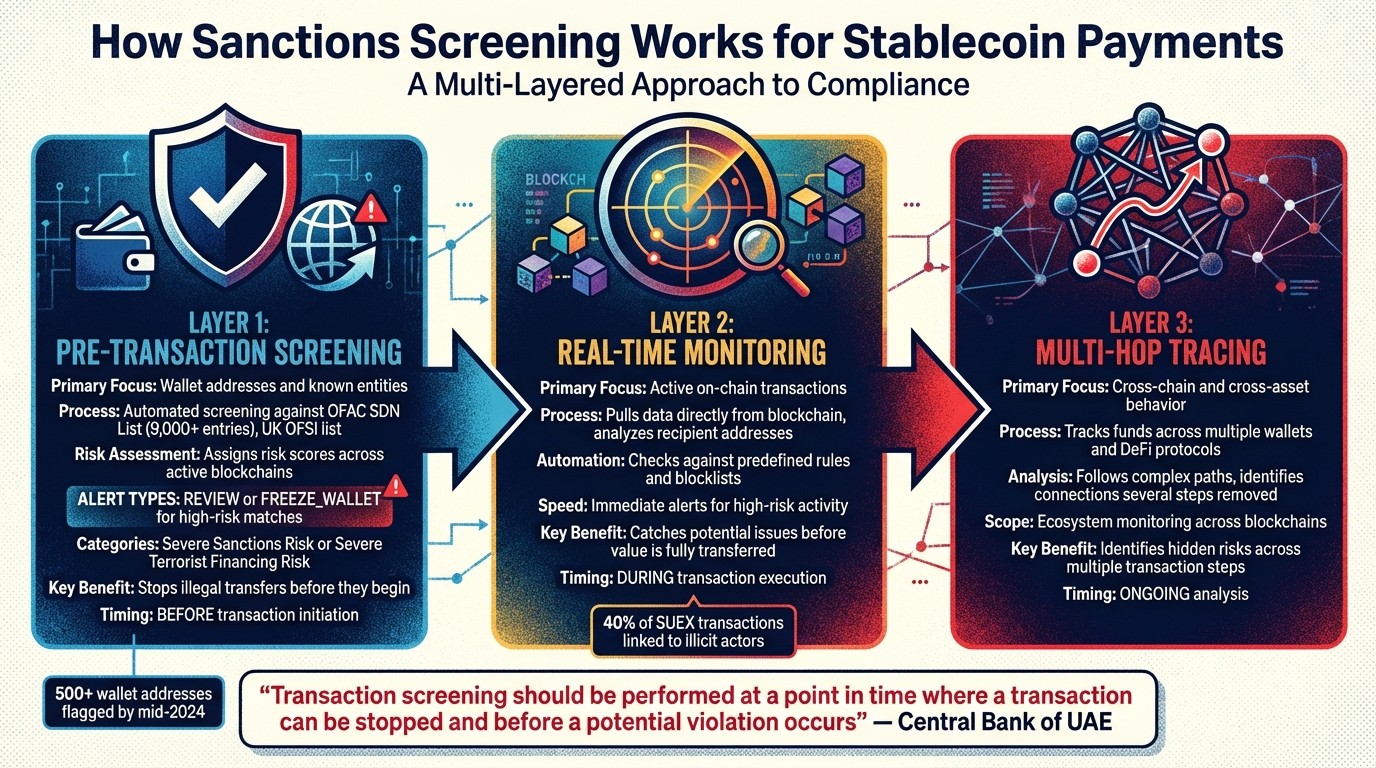

How Sanctions Screening Works for Stablecoin Payments

Three-Layer Sanctions Screening Process for Stablecoin Payments

Screening stablecoin transactions for sanctions compliance involves a multi-layered approach: checking wallet addresses before transactions are initiated, monitoring activity as it happens on-chain, and tracing the movement of funds across multiple steps. Each layer plays a role in minimizing the risk of engaging with sanctioned entities. As the Central Bank of the UAE emphasizes: "Transaction screening should be performed at a point in time where a transaction can be stopped and before a potential violation occurs". In other words, the process must happen early enough to prevent violations rather than just documenting them after they occur.

Pre-Transaction Screening of Wallet Addresses

Before a stablecoin payment is sent, the recipient’s wallet address is automatically screened against global sanctions lists, such as the U.S. OFAC SDN List and the UK OFSI list. But this isn’t just a straightforward match-or-no-match process. Modern tools evaluate wallet risks across active blockchains and assign a risk score to each address. If a match or a high-risk profile is flagged, the system triggers alerts or specific actions. Developers often test these systems by sending funds to designated test addresses ending in 9999, which simulate sanctions hits. In such cases, the system might return results like "REVIEW" or "FREEZE_WALLET", categorizing the risk as "Severe Sanctions Risk" or "Severe Terrorist Financing Risk".

Beyond matching wallet addresses, these tools also analyze additional details, such as the names of the originators and beneficiaries, geographic data, and bank identification codes. This helps distinguish genuine matches from false positives. Once this initial screening is complete, continuous monitoring takes over to track ongoing transactions in real time.

Real-Time Transaction Monitoring

When a transaction begins, real-time monitoring systems step in. These tools pull data directly from the blockchain, analyzing recipient addresses for every transaction involving a specific stablecoin. The objective is to catch potential issues before the value is fully transferred, enabling intervention if needed. David Carlisle, Vice President of Policy and Regulatory Affairs at Elliptic, highlights the importance of this approach:

"The solution relies on a screening and alerting system that notifies issuers the moment that sanctioned actors attempt to interact with their stablecoin, allowing issuers to efficiently freeze or block high risk wallets".

Given the speed of stablecoin transactions, manual reviews are impractical. Automated systems check transactions against predefined rules, such as sanctions blocklists and terrorist financing categories, and issue immediate alerts when high-risk activity is detected.

Tracing Multi-Hop Fund Flows

Real-time alerts are just the beginning. Advanced tracing tools track how funds move across multiple wallets or through decentralized finance (DeFi) protocols. Sanctioned entities rarely send funds directly; instead, they use layering techniques to obscure the origin of the money. Tracing these multi-hop flows requires sophisticated analytics capable of following funds across complex paths and identifying connections to sanctioned entities, even several steps removed from the original transaction.

This process, often referred to as "ecosystem monitoring", provides stablecoin issuers with a broader view of risks across blockchains. It allows them to identify trends, pinpoint where risks originate, and assess their overall exposure over time. For example, North Korea has been known to swap stablecoins following cyberheists. In 2024, OFAC expanded its SDN List to include specific stablecoin addresses tied to Russian ransomware campaigns and North Korean hacking groups. These tools also analyze bank codes, geographic locations, and payment references to uncover hidden connections.

Screening Method | Primary Focus | Key Benefit |

|---|---|---|

Pre-Transaction Screening | Wallet addresses and known entities | Stops illegal transfers before they begin |

Real-Time Monitoring | Active on-chain transactions | Alerts issuers to suspicious activity in real time |

Multi-Hop Tracing | Cross-chain and cross-asset behavior | Identifies hidden risks across multiple steps |

Tools and Processes for Sanctions Screening

Securing stablecoin transactions against sanctions violations hinges on three critical technologies: blockchain analytics platforms that track on-chain activity, automated systems that compare transactions against global watchlists, and policy enforcement engines that block unauthorized payments before they are processed. Together, these tools form a robust defense for the transaction process.

Blockchain Analytics Tools

Blockchain analytics tools are indispensable for gaining detailed insights into on-chain activity. They analyze public ledger data and screen recipient addresses against sanctions lists on a large scale. These platforms evaluate the risk associated with all blockchains and assets linked to a wallet, creating a comprehensive view of potential exposure. High-risk addresses are assigned risk scores, triggering immediate actions like freezing or blocking.

Some advanced tools go further by performing attribution expansion - a method that identifies additional wallets connected to flagged addresses. This helps catch sanctioned entities that create new wallets to avoid detection. For instance, in March 2024, the U.S. OFAC sanctioned Netex24, a Moscow-based fintech, for facilitating payments to sanctioned entities like Sberbank. Two months later, Netex24 rebranded as "SafelyChange" in an attempt to bypass controls. Using blockchain intelligence, TRM Labs exposed that the rebranded entity was still operating with the same infrastructure, enabling firms to maintain blocks on their activities.

David Carlisle, Vice President of Policy and Regulatory Affairs at Elliptic, highlights the transparency advantage of stablecoin ecosystems:

"Because stablecoin transactions are transparent and recorded in public on the blockchain, issuers can harness data-driven insights about potential sanctions-related activity occurring in their ecosystem and work proactively to address related risks".

Tool Type | Primary Function | Key Advantage | Key Limitation |

|---|---|---|---|

Blockchain Analytics | Traces on-chain transactions and screens addresses | High transparency; detects "multi-hop" exposure to sanctioned entities | Can be bypassed by advanced "layering" techniques or privacy-focused tools |

Automated Screening | Matches transactions against global watchlists | Scales effectively for high transaction volumes | May generate "false positives" requiring manual review |

Geolocation Tools | Blocks IP addresses from sanctioned areas | Prevents access from restricted regions | Can be circumvented using VPNs or proxies |

Policy-as-Code | Automates enforcement of compliance rules | Stops out-of-policy transactions before execution | Needs frequent updates to align with evolving regulations |

Automated Screening Systems

Given the near-instant settlement times of stablecoin transactions, automation is essential. Automated screening systems extract recipient addresses from blockchain data and compare them to watchlists, including the U.S. OFAC SDN List, which currently exceeds 9,000 entries. If a match is detected, the system generates an immediate alert, allowing the payment to be halted before funds are transferred.

However, automation has its challenges, particularly with false positives. In high-transaction environments, alerts can be triggered by coincidental name matches or similar wallet attributes, requiring manual review to confirm genuine risks. Despite this drawback, manual screening is not a feasible alternative due to its inefficiency and susceptibility to human error.

Policy Enforcement and Anomaly Detection

In stablecoin payments, integrating policy enforcement with anomaly detection is critical to avoiding sanctions breaches. Policy-as-code systems convert compliance rules into automated logic that runs before transactions are executed. For instance, a company might implement rules such as "Payments to new addresses over $5,000 require CFO approval" or "Weekend transfers exceeding $10,000 need additional verification." Any transaction violating these rules is flagged or blocked.

Anomaly detection tools add another layer of protection by identifying unusual patterns, such as transactions at odd hours, amounts exceeding typical thresholds, or behaviors that suggest structuring. Geolocation intelligence further strengthens this system by blocking IP addresses from sanctioned regions and identifying suspicious login patterns. In one notable case, anomaly detection revealed that over 40% of a Russian virtual currency exchange's transactions were tied to illicit actors, showcasing the effectiveness of these tools. When used alongside blockchain analytics and automated screening, policy enforcement creates a multi-layered defense that prevents violations before they happen, rather than addressing them after the fact.

How Stablerail Handles Sanctions and Taint Screening

Stablerail acts as an advanced control layer that bridges the gap between custody and transaction signing. It empowers finance teams to manage payments with the precision of traditional bank wires while retaining the speed of blockchain settlements. Unlike custody platforms, which focus on key management but lack insight into business operations, Stablerail secures the decision-making process itself. Every transaction is screened against sanctions lists, internal policies, and behavioral patterns, ensuring robust oversight throughout the transaction lifecycle.

Self-Custodial MPC Wallets with Pre-Sign Checks

Stablerail leverages Multi-Party Computation (MPC) technology to enhance wallet security. By splitting private keys into encrypted shares across multiple devices, it ensures that funds are stored in MPC-based wallets across major blockchains (EVM-compatible chains, with Solana support in the pipeline) and stablecoins like USDC and USDT. This setup prevents any single party from having unilateral signing authority.

A standout feature is the pre-sign compliance checks. Before a transaction is signed, it undergoes rigorous screening, including:

Sanctions checks against global watchlists like the U.S. OFAC SDN List.

Taint and exposure analysis to evaluate transaction history.

Enforcement of policy rules and transaction limits.

Anomaly detection to flag unusual patterns.

Counterparty risk scoring to assess potential risks.

"The effectiveness of a stablecoin is only as strong as the wallet that holds it." – Frances Zelazny, Anonybit

This proactive approach ensures compliance issues are identified before a transaction is executed, reducing the risk of regulatory violations.

Risk Dossier Generation and Verdicts

Stablerail expands on its pre-sign checks with a detailed risk dossier system. When a payment intent is initiated - whether through an invoice, a payout file, or an API - Stablerail's agents compile a comprehensive Risk Dossier. This dossier includes:

Customer and transaction data.

Identity verification.

Risk scoring based on factors like Politically Exposed Persons (PEPs) or high-risk regions.

Enhanced Due Diligence (EDD) for flagged entities.

Using advanced AI, the system minimizes false positives by accounting for transliterations, nicknames, and spelling variations. The result is a clear verdict for each transaction: PASS, FLAG, or BLOCK. Each decision comes with a plain-English explanation, referencing specific evidence such as policy rules, timestamps, or identified risks. For high-risk cases, actions like freezing or blocking transactions are triggered automatically. However, human approvers remain in control, reviewing dossiers and making final decisions when needed. This "copilot, not autopilot" model blends automation with human oversight for critical calls.

Audit Trails for Regulatory Defense

From the moment a transaction is initiated to its final signature, every action is meticulously logged with timestamps, linking on-chain activity to off-chain identifiers. This ensures compliance with regulatory requirements, such as the U.S. OFAC mandate to retain transaction records for at least five years.

"This information can prove invaluable in demonstrating to relevant supervisory authorities and other stakeholders that the issuer is adequately preventing sanctions risk from proliferating within their stablecoin ecosystem." – David Carlisle, Vice President of Policy and Regulatory Affairs, Elliptic

Stablerail’s audit trail system also supports mandatory reporting. Companies that self-disclose violations, backed by detailed records, may reduce potential civil penalties by up to 50%. By integrating audit trails with its screening and risk assessment processes, Stablerail turns compliance documentation into a strategic asset. This approach not only meets regulatory demands but also provides CFO-level evidence to strengthen a company’s regulatory defense.

Best Practices for Sanctions Compliance

Ensuring compliance with sanctions in the context of stablecoins requires a proactive, multi-layered approach. The Office of Foreign Assets Control (OFAC) enforces a strict liability standard, meaning businesses can face penalties even if they were unaware of a violation. However, companies with robust compliance programs and those that voluntarily report violations can reduce fines by up to 50%. The key is to build systems that anticipate risks, reducing the likelihood of reactive penalties. Below are practical steps to integrate compliance into every stage of transactions.

Conducting Regular Risk Assessments

Regular risk assessments are crucial to spotting vulnerabilities before they escalate into violations. These evaluations should analyze your company’s exposure to foreign jurisdictions, customer profiles, and counterparties, tailoring controls to your specific risk landscape. Static screening alone won’t cut it - sanctioned entities frequently adapt, rebranding or setting up new operations to evade controls. This is why periodic rescreening of historical transaction data is vital to catch newly designated entities or altered addresses.

Beyond one-off audits, consider using scenario analyses to test your team’s response to new sanctions or complicated evasion tactics. Tools like IP geolocation can help identify users from sanctioned regions and flag suspicious behaviors, such as logging in from the U.S. and Japan within an unreasonably short time frame. Incorporating geolocation data into your screening process strengthens compliance efforts.

Human-in-the-Loop Approvals for High-Risk Transactions

While automated systems are great for initial screening, human oversight is indispensable for complex or ambiguous cases. Human-in-the-loop (HITL) processes ensure that flagged transactions receive proper investigation before being approved or rejected. This is especially critical for "gray area" cases, where blocking requirements might not be immediately clear, or when anomalies arise that require deeper context. To prepare for such situations, establish detailed escalation playbooks that outline how to handle flagged transactions or blocked counterparties. These should be ready well before any incidents occur.

"The first time you run into a real incident is not the time to design your controls. Build the playbook during the pilot." – Stablecoin Insider

HITL processes work best with strong support from senior management. Assign a dedicated sanctions compliance officer with the authority and resources to act effectively, and ensure compliance is a key part of leadership discussions. Human reviewers need access to comprehensive data - such as customer profiles, identity verification, and counterparty risk scores - to make informed, timely decisions.

Adapting to Changing Sanctions Regulations

Sanctions compliance isn’t static; it must evolve alongside ever-changing regulations. For example, sanctions lists are updated frequently, with designation events tripling from 11 in 2022 to 33 in 2023. By late 2021, the OFAC SDN List had grown to include over 9,000 names, and by mid-2024, more than 500 wallet addresses had been flagged. Staying compliant means actively monitoring these updates. Subscribing to the U.S. Treasury’s email alerts can help you stay informed of changes to the SDN List.

Legislative developments also demand attention. In January 2026, U.S. Congress held hearings on stablecoin regulations under the GENIUS Act, signaling heightened scrutiny in the sector. To keep up, companies need flexible compliance frameworks that can adapt quickly to new rules. Documenting payment pathways and identifying regional compliance risks can help address bottlenecks. When breaches occur, conduct root cause analyses to pinpoint and fix the vulnerabilities that allowed the violation.

"Sanctions compliance is always an ongoing challenge, but by deploying Ecosystem Monitoring, issuers can ensure they adhere to OFAC and other sanctions requirements by having the ability to move proactively against sanctions-related risks where they emerge." – David Carlisle, Vice President of Policy and Regulatory Affairs, Elliptic

The most effective compliance programs treat sanctions screening as a continuous effort rather than a one-time task. By combining regular risk assessments, human oversight for high-risk decisions, and proactive monitoring of regulatory changes, businesses can transform compliance from a liability into a strategic asset.

Conclusion

Sanctions screening for stablecoin payments isn't optional - it’s a critical safeguard against hefty penalties and reputational harm. By mid-2024, the U.S. had flagged over 500 crypto wallet addresses on its SDN List, while the UK had designated more than 100. Sanctions designations have surged, with events tripling from 11 in 2022 to 33 in 2023. Organizations that fail to implement proper controls risk enforcement actions that can cost billions.

Relying solely on static screening falls short. Sanctioned entities are constantly evolving - creating new wallets, rebranding, and using advanced techniques to hide their activities. To stay ahead, compliance requires a dynamic, multi-layered approach. This includes pre-transaction screening, real-time monitoring, behavioral analytics, and human oversight for high-risk scenarios.

As discussed earlier, combining pre-transaction screening with ongoing risk assessments and human intervention shifts compliance from being a reactive chore to a strategic asset.

Stablerail addresses these compliance challenges by embedding rigorous controls directly into its payment workflow. Before any transaction is signed, the platform performs mandatory pre-sign checks to screen wallet addresses, enforce policies, and flag anomalies. Each transaction generates a detailed Risk Dossier with a clear outcome (PASS/FLAG/BLOCK) and straightforward explanations, creating a strong audit trail for regulatory purposes. By integrating self-custodial MPC wallets with automated screening and human oversight, Stablerail ensures finance teams can achieve the speed of on-chain settlements while upholding governance standards comparable to traditional banking systems.

FAQs

Why do stablecoin transactions pose a higher risk of sanctions violations?

Stablecoin transactions happen almost instantly across borders, using pseudonymous blockchain addresses. While this speeds up the process, it also creates a layer of anonymity that can hide the identities of the people involved. This opens the door for bad actors to shuffle transactions, move money across multiple blockchains, and mask the real sources or destinations of funds.

These features make it easier for individuals or groups to sidestep sanctions, enabling schemes to evade regulations and avoid oversight. To counter these risks, strong screening and monitoring systems are essential to identify and address potential violations effectively.

How do U.S. and EU sanctions regulations differ for stablecoin transactions?

In the United States, stablecoin transactions fall under the watchful eye of the Treasury's Office of Foreign Assets Control (OFAC). Operating on a strict-liability basis, OFAC requires all entities to screen both senders and recipients against the Specially Designated Nationals (SDN) list, as well as other sanctions lists. If any party involved in a transaction appears on these lists, the transaction must either be blocked or rejected. Since stablecoins are considered a form of virtual currency, they are held to the same screening and reporting standards as other types of crypto-assets.

Meanwhile, in the European Union, compliance revolves around the EU consolidated sanctions list, which is managed by bodies like the European Commission. Although the EU's system differs in structure and enforcement methods, it also underscores the need for strong compliance measures when handling stablecoin transactions. Still, the specifics of how sanctions apply to stablecoins in the EU can vary, often requiring additional clarification from EU authorities.

How can businesses ensure compliance with sanctions screening for stablecoin payments?

Sanctions screening for stablecoin payments is all about ensuring that every payment address, counterparty, and transaction aligns with the necessary sanctions lists - like the OFAC SDN list or the UK’s OFSI list - before funds move on-chain. Since stablecoins settle almost instantly, real-time or pre-sign checks are essential to block restricted transactions before they can be executed.

To stay compliant, businesses can rely on automated tools to screen payer and payee information against the most up-to-date sanctions lists. These tools are designed to spot potential matches, weed out false positives, and flag high-risk transactions for closer inspection. For instance, payments exceeding $10,000 or those processed over the weekend might need extra layers of approval. By weaving these checks into the payment process, companies can meet regulatory demands while keeping the speed of stablecoin transactions intact.

Platforms like Stablerail make this process easier by performing pre-sign checks for sanctions compliance, policy enforcement, and anomaly detection on every transaction. They also offer features like audit trails, clear explanations for flagged payments, and customizable rules to uphold governance and transparency. This allows businesses to stay compliant while enjoying the efficiency and convenience that stablecoin payments provide.

Related Blog Posts

Ready to modernize your treasury security?

Latest posts

Explore more product news and best practices for using Stablerail.