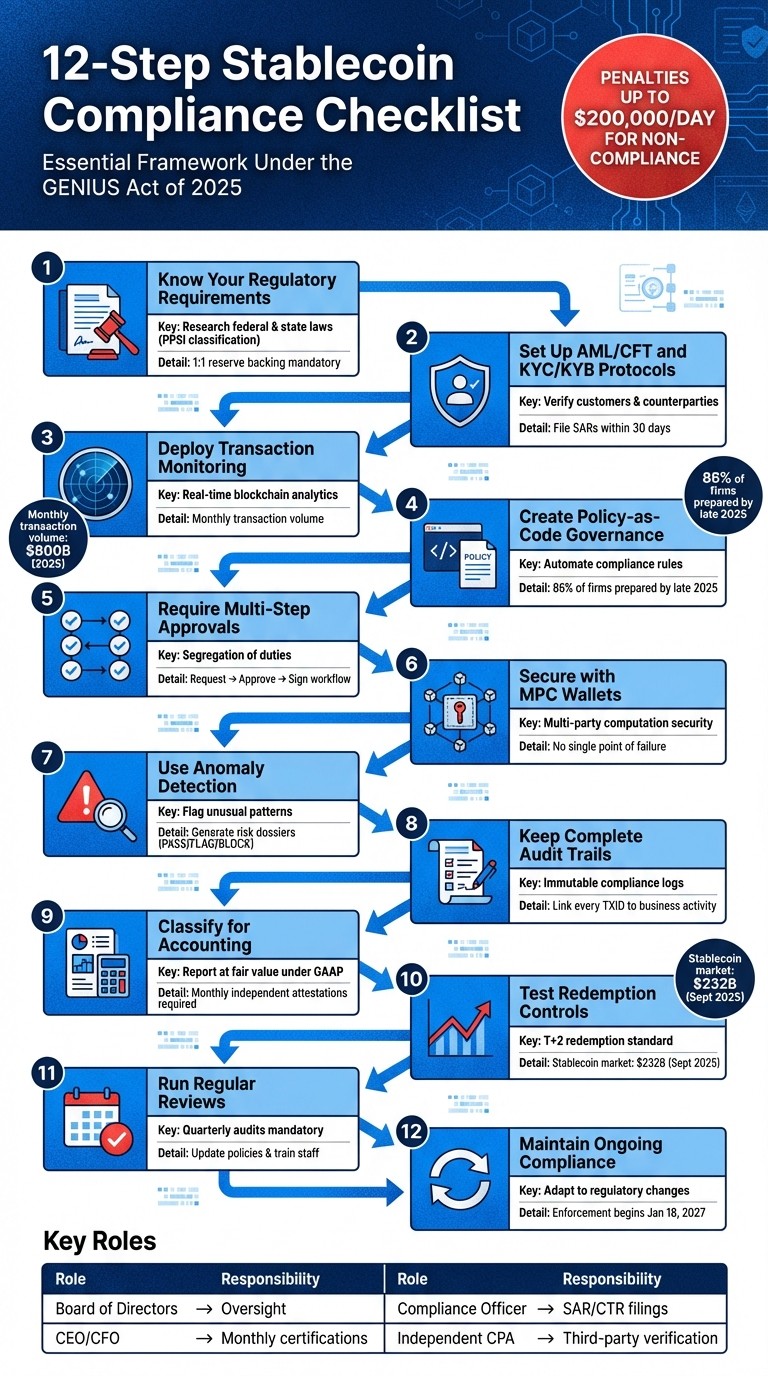

Stablecoins are now treated like traditional financial assets, thanks to the GENIUS Act of 2025. This law enforces strict rules for reserve backing, reporting, and transaction monitoring. Non-compliance can lead to fines of up to $200,000 per day and even criminal charges for executives. To avoid these risks, finance teams must follow a structured 12-step compliance checklist. Key actions include:

Understanding regulations: Know federal and state requirements, including 1:1 reserve backing.

Implementing AML/KYC protocols: Verify customers, screen transactions, and stay Travel Rule compliant.

Automating monitoring: Use tools for real-time risk screening and anomaly detection.

Establishing governance: Set up multi-step approvals, policy enforcement, and secure MPC wallets.

Testing redemption controls: Ensure liquidity and readiness for high-volume redemptions.

Conducting regular audits: Review policies, logs, and filings quarterly to stay compliant.

Compliance isn’t optional - it's a legal requirement. With penalties and reputational risks on the line, these steps help teams manage stablecoins responsibly while meeting regulatory expectations.

12-Step Stablecoin Compliance Checklist for Finance Teams

Step 1: Know Your Regulatory Requirements

Research Local and International Laws

Start by understanding the regulatory landscape for your organization. Determine whether you qualify as a Permitted Payment Stablecoin Issuer (PPSI) or require state-level authorization. According to 12 U.S. Code § 5903, issuers can operate under two categories: “Federal qualified payment stablecoin issuers,” regulated by the Comptroller of the Currency, or “State qualified” issuers, overseen by state regulators. If a state-chartered issuer’s assets exceed $10 billion, they must transition to federal oversight.

Compliance with reserve requirements is critical. Stablecoins must be backed 1:1 by reserves, as mandated by law. These reserves should consist of high-quality liquid assets, such as U.S. currency, Treasury bills maturing in 93 days or less, or eligible repurchase agreements. Rehypothecation - using reserve assets as collateral - is strictly limited to specific liquidity needs.

For organizations operating internationally, adherence to FATF standards is essential. This includes compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) rules, as well as the "Travel Rule", which mandates sharing originator and beneficiary information for transfers of $3,000 or more. Additionally, teams must keep up with regional regulations like the EU’s Markets in Crypto-Assets (MiCA) framework and guidelines from the Monetary Authority of Singapore.

Once you’ve mapped out the legal requirements, the next step is building a compliance governance framework.

Set Up Compliance Governance

After researching applicable laws, establish a strong internal compliance structure. This begins with formal governance and clear accountability. Stablecoin issuers are required to appoint a compliance officer to oversee their AML program. The compliance officer is tasked with managing the four key components of AML: internal controls, employee training, independent testing, and customer due diligence.

The board of directors also plays a vital oversight role. They must approve written AML programs and cybersecurity frameworks, while also reviewing regular reports on vulnerability management and penetration testing. Executive accountability is equally important:

Each month, the Chief Executive Officer and Chief Financial Officer of a permitted payment stablecoin issuer shall submit a certification as to the accuracy of the monthly report.

This certification is not just a formality - false statements can lead to personal criminal liability for CEOs and CFOs. To avoid errors, finance teams should implement rigorous review processes to ensure reserve data is accurate before executives sign off on monthly disclosures.

Here’s a summary of key roles and their compliance responsibilities:

Role | Primary Responsibility | Key Compliance Output |

|---|---|---|

Board of Directors | Oversight | Board-approved AML and IT risk programs |

Compliance Officer | Program Implementation | SAR/CTR filings and sanctions screening logs |

CEO / CFO | Financial Accountability | Certified monthly reserve reports |

Independent CPA | Third-party Verification | Monthly examination letters and annual control reports |

Stablecoins to Scale A Compliance Playbook After GENIUS

Step 2: Set Up AML/CFT and KYC/KYB Protocols

Once governance is in place, the next step is implementing strong AML/CFT protocols. These are non-negotiable for any financial institution dealing with stablecoins. Your finance teams should create an AML policy that aligns FATF guidelines with local laws, such as those set by the SEC in the U.S. or MAS in Singapore.

You'll also need to appoint a compliance officer who understands both financial law and blockchain technology. This person will be responsible for overseeing identity verification, sanctions screenings, and filing Suspicious Activity Reports (SARs) within 30 days.

From there, focus on verifying the identities of your customers and counterparties to build a solid compliance framework.

Verify Customers and Counterparties

Accurate identity verification is the backbone of preventing errors before transactions are signed. For individual customers, KYC protocols should incorporate tools like biometric liveness detection, address proofing, and device fingerprinting. When dealing with businesses, KYB protocols are necessary to confirm details about the company, its beneficial owners, and key executives.

A risk-based approach works best here. For low-risk users, simplified checks might suffice. However, high-value transactions or frequent transfers should trigger enhanced due diligence (EDD) measures, including source-of-funds verification. Additionally, always cross-check clients against sanctions lists, such as the U.S. Specially Designated Nationals (SDN) list and other relevant international databases. According to NY DFS guidelines, stablecoin holders must complete onboarding and meet all KYC/AML requirements to exercise redemption rights within the T+2 period.

Verification Layer | Purpose | Key Components |

|---|---|---|

Identity Verification | Confirm legal identity | Government-issued ID, Passport, Driver's License |

Biometric Verification | Prevent identity theft | Liveness detection, facial recognition, 3D selfies |

Database Screening | Identify criminal risk | PEP lists, Sanctions (OFAC/UN), Watchlists |

Address Verification | Confirm residency | Utility bills, bank statements, official mail |

Comply with the Travel Rule

For stablecoin transfers of $3,000 or more, the Travel Rule mandates that specific information be captured and shared. This includes the originator's name, account number, and location, as well as the beneficiary's name and account number, which must be passed to the counterparty financial institution.

When handling inbound transfers, match Virtual Asset Service Provider (VASP) data with your internal KYC records. Automating VASP attribution helps determine if a counterparty wallet belongs to a regulated entity. Set up timeout timers to manage data exchange requests, and flag transactions for manual review if no response is received within the defined time window. Use webhooks to get real-time updates on transaction statuses like awaitingCounterparty, completed, or counterpartyMismatchedData.

"In stablecoin payments, compliance isn't just a checkbox: it's what keeps money moving at scale." – Fireblocks

Step 3: Deploy Transaction Monitoring and Risk Screening

Once you've implemented KYC/KYB protocols, the next step is to establish ongoing monitoring systems that can detect suspicious activity before transactions are finalized. At this stage, finance teams move beyond just verifying identities and start assessing the risk profile of each transaction, including evaluating the "taint" of the funds involved.

Under the GENIUS Act of 2025, stablecoin issuers are classified as "financial institutions" under the Bank Secrecy Act. This classification requires them to conduct thorough suspicious-activity monitoring. Considering the massive growth in stablecoin usage - monthly transaction volumes reached around $800 billion by late 2025 - manual reviews are no longer feasible. Automated systems, designed to work at the speed of blockchain settlements, have become essential for identifying irregularities in real time.

Set Up Real-Time Blockchain Analytics

Real-time blockchain analytics use AI and machine learning to spot unusual patterns in transaction behavior. These systems analyze deviations in transaction velocity, unusual transfer sizes, and interactions with suspicious counterparties. By creating a behavioral baseline for every user - essentially defining what "normal" activity looks like - they can quickly flag anomalies. For instance, a series of small transfers to multiple exchanges in a short period could suggest layering tactics, a common money laundering technique.

Blockchain forensics play a critical role in tracing funds across wallets and blockchains, uncovering potential links to money laundering networks. For example, 82% of crypto volumes tied to sanctioned entities globally were traced to inflows at the Russia-based exchange Garantex. Without these tools, finance teams risk unknowingly engaging with high-risk networks. Geolocation analysis adds another layer by identifying the physical origins and destinations of transactions, helping to pinpoint exposure to restricted or sanctioned jurisdictions. Together, these analytics form the foundation for automated sanctions and taint screening.

Add Sanctions and Taint Screening

Every wallet address involved in a transaction should be cross-checked against OFAC and UN sanctions lists before approval. U.S. financial institutions are strictly prohibited from processing transactions with sanctioned individuals, entities, or nations. Violations can lead to civil penalties of up to $1,000,000 per infraction under the GENIUS Act.

Taint screening helps determine whether funds have passed through high-risk entities, mixers, or sanctioned wallets. Automated screening tools can compare wallet addresses and transaction metadata against constantly updated sanctions lists in real time, blocking or flagging questionable transactions before they are executed. These systems can also be configured to detect red flags like unusual "For Further Credit" instructions, rapid movement of funds, or jurisdictional mismatches.

"The biggest risk isn't exposure to crypto - it's not knowing you're exposed at all." – TRM Labs

Step 4: Create Policy-as-Code Governance

After establishing real-time monitoring and risk screening, the next step is turning board-approved policies into enforceable digital rules. This is where Policy-as-Code (PaC) comes into play. PaC integrates compliance directly into your transaction systems, ensuring that every stablecoin payment aligns with your governance framework before it gets approved. Essentially, it applies the same kind of internal controls to digital asset transactions as those used for traditional banking.

"A strong policy is the foundation of crypto treasury management. It aligns executive intent with practical controls and creates a shared language for risk." – BitGo

By late 2025, 86% of firms reported their systems were prepared for stablecoin adoption. However, many still rely on manual approvals. PaC eliminates much of the risk of human error by digitizing approval processes, ensuring every transaction complies with both internal policies and external regulations. These digital rules create a structured, rule-based approach to managing transactions.

Define Approval Thresholds and Rules

Once you’ve automated core processes, the next step is to define specific control parameters that reflect your organization’s risk tolerance. Examples of these rules might include:

Transaction limits: For instance, capping transfers at $5,000 and requiring CFO approval for anything exceeding that amount.

Address filtering: Using allowlists to restrict transfers to approved parties or blocklists to prevent interactions with high-risk or sanctioned wallets.

Time-based restrictions: Blocking large weekend transfers or adding time-locks for certain transactions to allow for additional review.

These rules are often defined using JSON-based logical expressions that are evaluated automatically before any transaction is processed. For instance, a rule might specify ethValue <= 1000000000000000000 (1 ETH) or confirm whether an address is on an allowlist. Policies can be applied broadly across a project or tailored to individual accounts for more detailed control.

Another key element is segregation of duties - ensuring that the person requesting a payment, the person approving it, and the person signing the transaction are all different individuals. This separation adds an extra layer of security and accountability.

Automate Policy Enforcement

Once your rules are in place, automation ensures they’re applied consistently to every transaction. This is especially vital under the GENIUS Act of 2025, which mandates that stablecoin issuers maintain the ability to block and freeze transactions that violate federal or state laws.

Automated platforms can process cases up to 120 times faster than manual methods and reduce workloads by as much as 95%. By integrating policy enforcement with Multi-Party Computation (MPC) wallets, transactions can only be signed if all governance rules are met. Additionally, automated compliance platforms log every action with a timestamp, creating an immutable audit trail for regulatory reviews.

For example, Stablerail’s Policy Console embeds these controls directly into the pre-signature workflow. This allows finance teams to operate at blockchain speed while maintaining strict governance and compliance.

Step 5: Require Multi-Step Approval Workflows

After automating your policy rules, the next essential step is implementing multi-step approval workflows. These workflows are designed to ensure that no single individual has the authority to independently transfer funds - a principle often referred to as dual control or segregation of duties. By adding this layer of oversight, you can further secure stablecoin transactions. As Amy Kalnoki from Bitwave explains:

"Stablecoins are as final as cash - once sent, they're gone. That's why you need the same internal guardrails you'd use for large wire transfers".

The key here is separating roles within the transaction process. For example, one person might request a payment, another would approve it, and a third would sign the transaction. For more sensitive or high-value transfers, additional layers of approval can be added. For instance, any transaction exceeding $5,000 might require sign-off from a CFO. This tiered approach ensures that risk is managed appropriately: a $500 vendor payment might need only a manager’s approval, while a $50,000 transfer to a new counterparty could escalate to the CFO and require documented justification. Tools like Stablerail's Policy Console allow finance teams to set these thresholds based on factors like wallet, role, asset type, or counterparty - and enforce them before any transaction is finalized.

Every approval and signing action should be logged in immutable audit trails that link specific actions to individual users. These records are crucial for SOC 1/SOC 2 audits and regulatory reviews. When combined with MPC wallets, this system ensures that funds can only be transferred if every step meets predefined criteria and is properly documented.

This setup provides the best of both worlds: the speed of blockchain settlements paired with the oversight of traditional financial controls. With these multi-step workflows in place, the foundation is set to further enhance transaction security and audit readiness.

Step 6: Secure Funds with Self-Custodial MPC Wallets

Managing assets securely is a cornerstone of stablecoin treasury governance, especially during the pre-signature process. Once multi-step approvals are complete, it's crucial to safeguard the funds. This is where Multi-Party Computation (MPC) wallets come into play. These wallets divide signing authority among several participants, creating digital signatures collaboratively without ever reconstructing the full private key in one place. This ensures no single person can move funds on their own.

Even if one key share is compromised, attackers cannot produce a valid signature. This eliminates the single point of failure common in traditional key systems, adding an extra layer of protection by enforcing dual control at the cryptographic level.

MPC wallets also bring flexibility. Unlike on-chain multi-signature solutions, MPC operates off-chain, allowing for broader asset coverage across multiple networks such as Ethereum, Base, or Polygon. This adaptability is especially useful for treasury operations that span different blockchain ecosystems, ensuring compliance with high standards.

Another advantage of MPC systems is their ability to generate immutable audit logs linked to specific users. These logs are essential for meeting compliance requirements like SOC 1/SOC 2 audits and ISO/IEC 27001 standards. Platforms like Stablerail use MPC-based wallets to ensure funds remain in self-custodial vaults, preventing the platform itself from initiating any transfers.

To maximize security and compliance, finance teams should establish least-privilege roles. This means separating responsibilities: one group requests payments, another approves them, and a third manages the MPC key shares. For high-value or high-risk transactions - such as those exceeding $10,000 - introduce additional "step-up" approvals for extra oversight. Additionally, store encrypted backups of key shares in geographically diverse locations and conduct regular recovery drills to ensure operational resilience.

Step 7: Use Anomaly Detection and Risk Dossiers

Detect Unusual Transaction Patterns

Anomaly detection adds an extra layer of scrutiny to your real-time analytics, helping to pinpoint suspicious transaction behaviors. These systems are designed to flag transactions that deviate from the norm - whether it’s unexpected timing, irregular amounts, or rapid fund transfers - before the money leaves the wallet.

For example, they can uncover techniques used to mask illegal activities, like layering and splintering, which obscure the origin of funds. Imagine your company usually processes vendor payments of $2,000–$3,000 on weekdays. If a $15,000 transfer suddenly pops up at 2:00 AM on a Saturday, that’s a red flag worth investigating.

Advanced systems also catch issues like velocity coupling (a surge in transaction frequency) and jurisdictional mismatches, which could indicate high-risk transfers. A case from late 2022 illustrates this well: a syndicate used a shell company, "Sea Dragon Remodel Inc.", to launder money through 60 shell accounts in U.S. banks. They mixed wire transfers, checks, credit cards, and cryptocurrency to hide their tracks. Insights like these feed directly into comprehensive risk dossiers for every transaction.

Generate Risk Dossiers for Each Transaction

Risk dossiers, like those created by Stablerail, turn blockchain data into actionable outcomes - classifying transactions as PASS, FLAG, or BLOCK, with clear reasons behind each decision.

These dossiers are essential for compliance. They provide the documentation needed to file Suspicious Activity Reports (SARs) when thresholds are met, such as transactions over $25,000 or $5,000 if a suspect is involved. They also check wallet addresses in real time against the OFAC Specially Designated Nationals (SDN) list, helping to avoid accidental dealings with sanctioned entities. Each dossier includes links to relevant policy clauses, timestamps, and behavioral patterns, ensuring that every detail is accounted for.

Step 8: Keep Complete Audit Trails

After establishing pre-signature controls, maintaining detailed audit trails becomes essential for verifying compliance. While blockchain provides transaction permanence, it doesn't eliminate the need for accurate corporate record-keeping. Auditors and regulators require clear documentation that links every on-chain transaction (TXID) to a specific business activity, such as an invoice, contract, or payroll record.

For every payment, it's crucial to document the intent behind it, the compliance checks performed (like sanctions, Travel Rule, and geolocation), the full approval chain with timestamps, and the final MPC or multi-sig signatures. Each step must be tied to a specific user for accountability.

Platforms like Stablerail simplify this process by automatically generating comprehensive logs for every transaction. When a payment intent is created, the system records the requester's details, performs real-time compliance checks, logs timestamps and identities of approvers, and tracks MPC signing events. This creates an unalterable evidence package that connects all pre-signature processes.

"Record every approval and signing event in immutable logs to meet SOC reporting expectations." – BitGo

To ensure complete documentation, reconcile stablecoin wallet balances monthly against internal ledgers and keep exportable backups of audit trails. A three-way reconciliation process - comparing on-chain data, custodian statements, and internal records - ensures every transaction is thoroughly documented and defensible.

Step 9: Classify Stablecoins for Accounting and Reporting

To align with updated GAAP standards, stablecoin holdings should be recorded at fair value instead of their historical cost. This means documenting their value as it fluctuates - whether it’s $0.99, $1.01, or another amount - rather than assuming a fixed $1.00 peg.

"Under new GAAP rules, report holdings at fair value - even if that's $0.99 or $1.01." – Amy Kalnoki, Co-Founder, Bitwave

For tax purposes, the IRS treats stablecoins as property. This requires recording income and assessing capital gains at their fair market value, using trusted pricing sources like Coinbase or CoinMarketCap. Additionally, any holdings on foreign platforms or with non-U.S. custodians must be included in FBAR and FATCA filings.

The GENIUS Act of 2025 introduced new disclosure requirements for stablecoin issuers. Issuers must now provide monthly independent attestations to confirm that reserves fully back the outstanding supply on a 1:1 basis. While these rules primarily apply to larger issuers, finance teams should still evaluate redemption policies, fees, and reserve composition when deciding which stablecoins to hold. To maintain accuracy, reconcile wallet balances with the general ledger every month.

This classification step is essential for preparing to test redemption and liquidity controls in the following phase.

Step 10: Test Redemption and Liquidity Controls

After classifying stablecoin holdings, the next step is to test the redemption processes to ensure everything runs smoothly under various conditions. By September 2025, the stablecoin market had grown to over $232 billion in circulation, highlighting the importance of these tests.

Finance teams should create simulations that mirror real-world challenges, such as gradual market declines and sudden, unexpected shocks. These tests should include scenarios like large-scale redemption requests, interest rate fluctuations, and failures of key counterparties. The goal? To ensure compliance with the T+2 redemption standard - meaning redemptions must be processed within two full business days after receiving a valid order, as required by regulators like the New York Department of Financial Services .

"Stress testing is critical: model adverse scenarios like large-scale redemptions, interest rate shocks, or counterparty failures." – Gate Learn

Looking back at historical events like TerraUSD's collapse in May 2022 and USDC's brief depeg in March 2023 reinforces why robust redemption controls are essential. TerraUSD faced massive redemption requests that overwhelmed its algorithmic stabilization mechanism, leading to a catastrophic "death spiral" where the token lost nearly all its value. Similarly, USDC temporarily lost its peg in March 2023 after Silicon Valley Bank's collapse, which impacted a portion of its reserves.

To prepare for such scenarios, ensure high-quality liquid assets - like cash and U.S. Treasury bills - are available to cover abnormal redemption volumes. Use an asset maturity schedule (also known as a maturity ladder) to ensure fixed-income assets mature at regular intervals. Independent evaluations of smart contracts and decentralized applications (dApps) that facilitate redemptions are equally important . Additionally, establish standby credit facilities or form agreements with market makers to secure liquidity during periods of extreme pressure. These proactive measures are vital to maintaining a strong liquidity strategy within a broader compliance framework.

Step 11: Run Regular Compliance Reviews

Once you've set up controls and testing mechanisms, the next step is to keep everything running smoothly through regular reviews. This is especially important in a world where stablecoin regulations are changing fast - take the GENIUS Act of 2025 as an example. What worked last year might not cut it today. For finance teams, compliance isn't a "set it and forget it" kind of deal; it's an ongoing process.

"Compliance is not a box-checking exercise, but an ongoing demonstration of transparency, accountability, and resilience." – Hacken

The idea here is to catch potential issues before auditors or regulators do. That means scheduling regular reviews, staying on top of new laws, addressing emerging risks, and learning from your own operations. Routine audits and policy updates are key to strengthening the controls that protect your transactions.

Perform Quarterly Audits

Make it a habit to audit your stablecoin governance and transaction processes every quarter. Start with a three-way reconciliation: compare on-chain TXIDs, custodian statements, and your internal records. If something doesn’t add up, dig into it.

Next, take a close look at your transaction monitoring logs. Check that every payment was screened against the OFAC Specially Designated Nationals (SDN) list and confirm that flagged transactions were properly escalated. Also, ensure that approval thresholds are being followed. For example, if your policies require CFO approval for transactions over $5,000, the logs should clearly show that this step was completed.

Don’t stop there. Review logs from your MPC wallets to confirm that only authorized personnel accessed them. Test your APIs, web apps, and networks for vulnerabilities on a periodic basis. If you’re using tools like Stablerail, verify that automated rules - like blocking unscreened address transfers - are working as they should.

Lastly, make sure all required regulatory filings are up to date. This includes Suspicious Activity Reports (SARs), Currency Transaction Reports (CTRs), and Travel Rule documentation.

Review Component | Frequency | Key Action |

|---|---|---|

Wallet Reconciliation | Monthly | Match on-chain TXIDs to internal invoices/contracts |

Reserve Attestation | Monthly | CPA examination of management's assertions on backing |

AML Program Testing | Quarterly/Annual | Independent audit of KYC/CIP and SAR filing logs |

Penetration Testing | Periodic | Risk-based testing of APIs, web apps, and internal networks |

Policy Updates | Quarterly | Review thresholds and update sanctions screening lists |

Update Policies and Train Staff

After completing your audits, make sure your policies are updated and your staff is trained to handle any regulatory changes. Use the findings from each quarterly audit to revise internal thresholds, approval workflows, and sanctions screening lists. For instance, the GENIUS Act now requires that stablecoin reserves consist only of cash, Federal Reserve deposits, or Treasury bills with a maximum maturity of 93 days. If your policies don’t reflect this, it’s time to revise them.

Staff training is equally important. Hold quarterly training sessions to keep everyone informed about updates to IRS rules, like the expected enforcement of Form 8300 for transactions over $10,000, as well as any new state-level requirements. Use these sessions to share lessons from recent audits and reinforce the importance of safeguarding digital wallets with the same care as physical cash. Blockchain transactions are final - there’s no undo button.

"The difference between scrambling when auditors come knocking and cruising through reporting season often comes down to systems." – Amy Kalnoki, Co-Founder, Bitwave

Take it a step further by running tabletop exercises and recovery drills. Simulate scenarios like lost devices, compromised signers, or large-scale redemption requests, and update your playbooks based on what you learn.

Lastly, don’t forget about third-party due diligence. Review SOC reports, bridge letters, and uptime histories for any custodians or exchanges you rely on. This ensures their internal controls meet your standards and align with the latest regulations. By treating compliance as an ongoing cycle of audits, updates, and training, you’ll create a governance framework that’s ready to handle whatever comes next.

Conclusion

Handling stablecoin transactions demands meticulous oversight. The 12-point checklist - covering everything from understanding regulatory requirements and implementing AML/KYC protocols to deploying transaction monitoring and conducting regular compliance reviews - lays the foundation for a solid treasury operation. Each step reinforces the next, establishing a governance framework that treats stablecoins as the critical financial instruments they have become. This structure not only addresses regulatory expectations but also boosts operational precision.

The GENIUS Act of 2025 underscores this shift: stablecoins are no longer experimental. Federal law now mandates that issuers maintain 1:1 reserves in U.S. Treasury bills with maturities of 93 days or less and produce monthly audited reports. These requirements elevate compliance standards to those expected of banks, with enforcement set to begin on January 18, 2027.

Platforms like Stablerail simplify compliance by automating key tasks such as sanctions screening, enforcing approval thresholds, and maintaining immutable audit trails. The result? Real-time risk assessments, automated policy enforcement, and CFO-grade documentation for every transaction - all while keeping control of your keys intact.

Ultimately, maintaining compliance is an ongoing process, requiring regular audits, policy updates, and staff training to keep pace with changing regulations. By embedding compliance into your risk management strategy, you’re not just meeting legal requirements - you’re building the resilience and transparency that regulators, auditors, and stakeholders demand.

FAQs

What are the main regulatory requirements for stablecoin issuers under the GENIUS Act of 2025?

Under the GENIUS Act of 2025, stablecoin issuers must adhere to strict guidelines to stay compliant. The law allows issuance only by insured banks, credit unions, federally qualified non-bank issuers, or state-qualified issuers with less than $10 billion in outstanding payment stablecoins. To safeguard financial stability, issuers are required to maintain 100% reserves in cash or high-quality liquid assets, with no rehypothecation permitted.

Issuers must also provide monthly reserve disclosures, certified by their CEO or CFO and reviewed by a registered public accounting firm. For those managing more than $50 billion in outstanding stablecoins, annual audited financial statements are an additional requirement. Furthermore, all issuers must comply with BSA/AML regulations and sanctions rules, under the oversight of either federal (OCC) or state authorities.

How can finance teams ensure AML and KYC compliance for stablecoin transactions?

Finance teams can maintain AML and KYC compliance by adopting a risk-based framework. This starts with thorough counterparty verification, which involves gathering key documents such as government-issued IDs, proof of address, and details about beneficial ownership. Before approving any stablecoin transactions, screen all parties against sanctions lists like those maintained by OFAC, the EU, and the UN. For higher-risk or high-value parties, enhanced due diligence is critical, allowing you to focus efforts where potential risks are the highest.

After onboarding, incorporate continuous monitoring into your processes. Set transaction thresholds - such as $10,000 or $50,000 - to flag unusual activity. Use AML tools to identify patterns like rapid transfers or cross-border movements that fall outside typical behavior. Retain transaction records and customer data for at least five years to comply with U.S. regulations and to ensure you can quickly report any suspicious activity.

Strong governance is the final piece of the puzzle. Assign a dedicated AML officer, enforce multi-level approvals for large payments, and routinely review your AML program to keep pace with changing regulations. Regular staff training and updates to policies are vital for maintaining secure and compliant stablecoin operations.

Why are regular audits and compliance reviews essential for managing stablecoins?

Regular audits and compliance reviews play a key role in ensuring that stablecoin reserves are consistently backed and aligned with regulatory standards. These reviews help uncover potential operational or regulatory risks early, giving finance teams the chance to address issues before they escalate.

By performing these reviews, organizations can keep clear and audit-ready records. This not only meets regulatory expectations but also strengthens trust with stakeholders. Such practices uphold the credibility of stablecoin operations and contribute to secure and compliant treasury management.

Related Blog Posts

Ready to modernize your treasury security?

Latest posts

Explore more product news and best practices for using Stablerail.