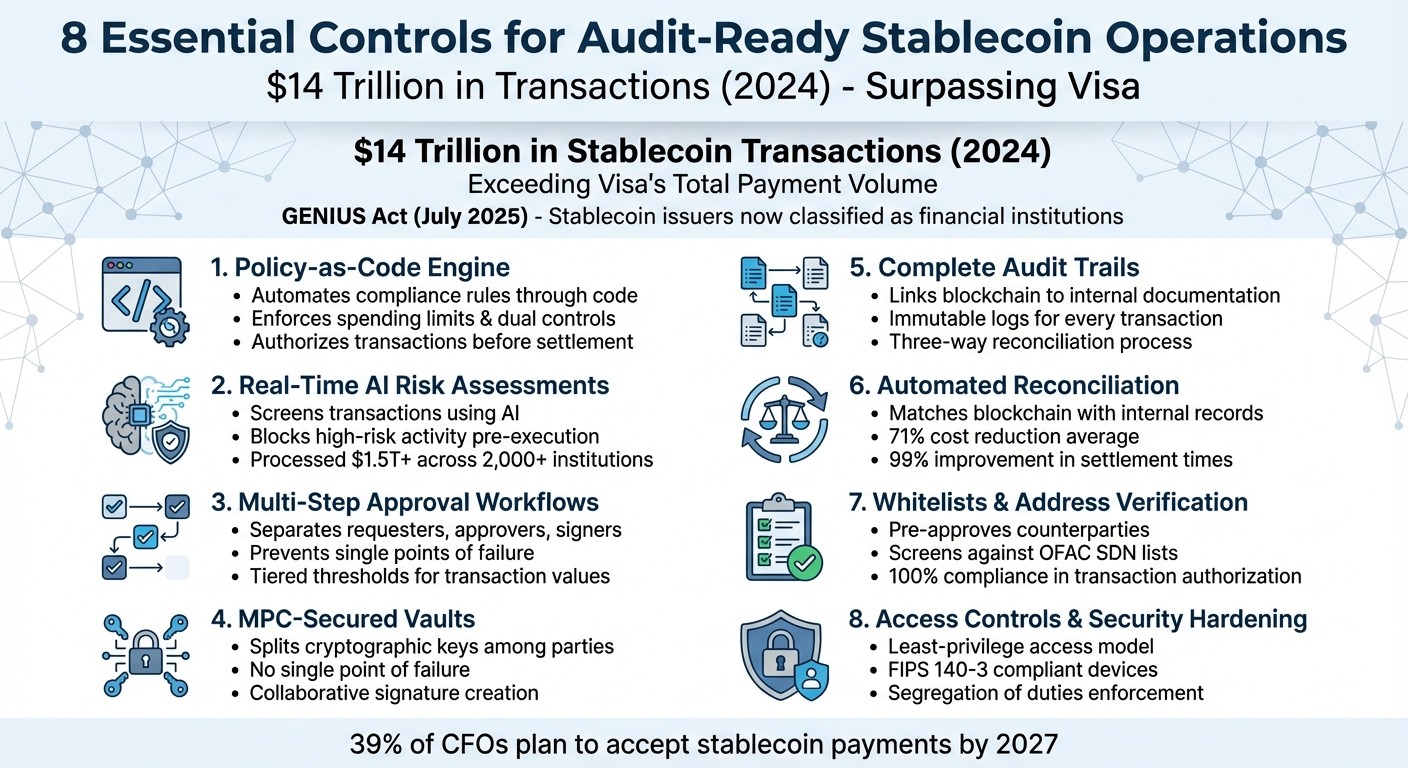

Stablecoins processed $14 trillion in transactions in 2024, surpassing Visa. While they offer speed and efficiency, they also come with risks like irreversible transactions and bearer asset vulnerabilities. To manage these challenges effectively, treasury teams must implement robust controls to ensure security, compliance, and audit readiness. Here are eight key controls:

Policy-as-Code Engine: Automates compliance rules (like spending limits and dual controls) through code, ensuring transactions are authorized before settlement.

Real-Time AI Risk Assessments: Uses AI to screen transactions, enforce policies, and block high-risk activity before execution.

Multi-Step Approval Workflows: Separates roles (requesters, approvers, signers) to reduce errors and insider threats.

MPC-Secured Vaults: Splits cryptographic keys among multiple parties, preventing single points of failure.

Complete Audit Trails: Links blockchain transactions to internal documentation, creating immutable logs for audits.

Automated Reconciliation: Matches blockchain data with internal records to eliminate errors and delays.

Whitelists and Address Verification: Pre-approves counterparties and screens addresses to prevent illicit transfers.

Access Controls and Security Hardening: Limits permissions, enforces segregation of duties, and secures signing devices.

These controls align with new regulations, including the GENIUS Act (July 2025), which classifies stablecoin issuers as financial institutions under the Bank Secrecy Act. By adopting these measures, treasury teams can handle growing transaction volumes securely and remain compliant with evolving standards.

8 Essential Controls for Audit-Ready Stablecoin Operations

GENIUS Act & Stablecoins: Top FAQs for Corporate Treasury

1. Policy-as-Code Engine

A Policy-as-Code (PaC) engine is a key component of maintaining audit-ready stablecoin operations. It replaces outdated manual processes - like checklists and email approvals - with automated, code-driven rules that enforce treasury policies before any transaction hits the blockchain. Instead of juggling spreadsheets and manual approvals, compliance rules - such as spend limits, whitelists, and dual controls - are written directly into code using languages like Python, YAML, or Rego. These rules are then executed through APIs, incorporating sanctions screening and blockchain analytics. This automated system integrates seamlessly with real-time compliance and risk assessments outlined later in this article.

Automation of Risk and Compliance Processes

The PaC engine ensures every transaction is authorized before settlement. This means treasury teams can screen transactions against OFAC sanctions lists, confirm Travel Rule compliance, and enforce velocity limits - all before exposing the settlement address. Following the GENIUS Act - enacted on July 18, 2025 - stablecoin issuers are now classified as financial institutions under the Bank Secrecy Act, making these automated checks a legal requirement. High-volume compliance networks show that these pre-transaction protocols can scale effectively without causing operational slowdowns.

Mitigation of Operational and Insider Risks

Beyond risk checks, PaC engines are designed to enforce strict role separation, minimizing both errors and fraud. For example, dual controls prevent the same person from initiating and approving a payment. Treasury teams can implement safeguards like requiring two signers for transactions exceeding $5,000 or applying time locks to identify and block unauthorized actions. By embedding these rules into code, organizations avoid configuration drift and ensure consistent policy enforcement across all accounts and departments.

Audit-Readiness and Defensibility of Controls

Every action governed by the PaC engine is recorded in an immutable log, linking transactions to user identities and their specific business purposes. This detailed audit trail allows auditors - whether reviewing SOC 1/SOC 2 compliance or GENIUS Act adherence - to examine the exact code that governed each transaction, rather than relying solely on post-event documentation. Storing policy code in a Version Control System (VCS) further enhances transparency by maintaining a clear history of rule changes, including when they were made and by whom. This approach creates a robust framework of defensible controls, proving that compliance measures were actively enforced through code, not just documented on paper.

2. Real-Time AI Risk Assessments

Real-time AI risk assessments are redefining how stablecoin treasury management operates by focusing on prevention instead of reacting after issues arise. Since blockchain transactions are finalized almost instantly, risks need to be addressed before settlement occurs. Configurable policy engines bring together intelligence from various sources - like sanctions screening and blockchain analytics - to automate risk evaluations and block high-risk transactions before they’re completed. This proactive approach sets the foundation for the strong controls outlined below.

Automation of Risk and Compliance Processes

AI-powered systems are revolutionizing compliance by seamlessly linking internal treasury systems to external risk databases through APIs. These systems use AI to enforce compliance protocols, delivering faster and more precise decisions compared to traditional, static policies. Following the GENIUS Act, which takes effect on July 18, 2025, stablecoin issuers are now classified as financial institutions under the Bank Secrecy Act, making automated checks mandatory. A great example is Notabene's network, which has already processed over $1.5 trillion in transactions for more than 2,000 institutions using pre-transaction authorization protocols.

Mitigation of Operational and Insider Risks

By embedding institutional risk frameworks into automated processes, organizations can minimize manual interventions and reduce risks tied to operational errors or insider actions. Real-time monitoring of hot wallets enforces velocity limits and flags policy deviations, helping to prevent fraud and mistakes. These safeguards complement the controls discussed earlier in section 1. Additionally, AI tools keep a constant eye on reserve balances and liquidity buffers, ensuring they’re sufficient to meet redemption demands.

Audit-Readiness and Defensibility of Controls

Automated policy enforcement doesn’t just streamline operations - it also enhances audit-readiness by creating permanent, tamper-proof logs of every risk evaluation and authorization decision made before settlement. These systems conduct continuous three-way reconciliation, matching on-chain data with custodian statements and internal ledgers, eliminating the need for last-minute reconciliation efforts at the end of the month. Auditors reviewing SOC 1/SOC 2 compliance or GENIUS Act requirements can access detailed records, complete with timestamps that tie decisions to specific users and board-approved policies.

"Stablecoin systems can prevent illicit activity before settlement rather than detecting it afterward, provide transparency through immutable audit trails while preserving legitimate privacy, and enable real-time compliance at global scale." - Notabene

3. Multi-Step Approval Workflows

Multi-step approval workflows are designed to ensure no single individual can move stablecoin funds without proper oversight. The idea is simple: separate the roles of requesters, approvers, and signers. This division of responsibilities reduces the risk of a single point of failure and guards against both unintentional mistakes and intentional insider threats.

Reducing Operational and Insider Risks

By building on this structured workflow, organizations can implement stronger safeguards against risks. Tiered approval thresholds are one such measure, requiring higher levels of authorization for larger transactions. For instance, routine payments might only need a treasury manager's approval, but transactions exceeding a certain amount could require the CFO’s sign-off. Wallets can also be categorized to enforce stricter controls as transaction values increase. Additionally, time-locks can delay critical operations, like token minting or large transfers, giving stakeholders time to identify and stop unauthorized actions before they are finalized.

"Multi-signature controls require multiple approvals for key actions... preventing single points of failure and enhancing security for institutional use." - Elliptic

Strengthening Audit Trails and Accountability

Every approval should be logged with unchangeable records that link actions to verified identities, ensuring full traceability. This creates a clear chain of accountability, allowing auditors to track every step from the initial request to the final settlement. These records work hand-in-hand with other controls to form a robust audit trail. Under the GENIUS Act, CEOs and CFOs are required to personally certify monthly reserve reports, making these logs not just useful but legally defensible. To further reinforce this system, automated checks can be embedded to maintain an unalterable, verifiable chain of approvals.

Streamlining Treasury Operations

Layered controls don’t have to slow things down. Modern workflows integrate smoothly with existing treasury systems through APIs provided by trusted custodians. This allows for an efficient request-to-settle process, where automated routing and reconciliation match blockchain transactions with internal approvals. To optimize this setup, organizations should define clear approval thresholds in a board-approved policy and follow a least-privilege access model, ensuring employees only have the authority necessary for their specific roles.

4. MPC-Secured Self-Custodial Vaults

Multi-Party Computation (MPC) vaults offer treasury teams a way to manage stablecoins securely by eliminating the risk of a single point of failure. Instead of relying on one master key, MPC splits key material among multiple participants. This approach allows for collaborative signature creation without ever piecing together the full private key.

Reducing Operational and Insider Risks

MPC adds an extra layer of security by enforcing clear separation of duties. No single individual can both initiate and approve a transaction. Organizations can configure quorum-based approvals, such as requiring signatures from 2 out of 3 participants, to ensure decisions are collaborative. Additionally, velocity limits can be set to restrict transaction volumes within specific timeframes, and time-delay mechanisms prevent unauthorized high-value transfers by introducing a buffer period. These safeguards not only reduce the risk of insider threats but also create a detailed audit trail for accountability.

"MPC distributes key material across participants and produces signatures collaboratively without reconstructing a full private key." - BitGo

Strengthening Audit-Readiness and Control Defensibility

MPC systems are designed to create immutable logs that link every signature to a specific individual, meeting key requirements for SOC 1 and SOC 2 compliance. These detailed records provide essential evidence during reserve audits, showing exactly who initiated, approved, and signed each transaction. Changes to signer roles are also meticulously documented, demonstrating the strength and reliability of the controls in place. By combining technical safeguards with thorough documentation, MPC vaults significantly enhance the audit process.

Seamless Integration with Treasury Workflows

MPC vaults integrate effortlessly with existing treasury systems to improve operational security. API compatibility allows for automated on-chain reconciliation and supports wallet tiering, such as using cold wallets for reserves and warm wallets for routine transactions, all under strict spending caps. By working alongside tools like policy-as-code and multi-step approval processes, MPC vaults deliver a cohesive and audit-ready system for stablecoin management. Regular recovery drills are essential to ensure that encrypted key shares can be restored from distributed backups, keeping the system resilient and secure.

5. Complete Audit Trails and Logging

Audit-Readiness and Defensibility of Controls

Every stablecoin transaction must create an unchangeable record that ties on-chain activity directly to internal business documentation. This means transaction IDs on the blockchain should be linked to supporting materials like invoices, contracts, or payroll records. A three-way reconciliation process - comparing on-chain data, custodian statements, and internal records - ensures the accuracy of audits. This type of logging works seamlessly with previously discussed controls, creating a consistent system for audit-readiness.

"Auditors don't want to click through Etherscan - they want clean records tied to your business activity." - Bitwave

The GENIUS Act, signed in July 2025, requires stablecoin issuers to provide independent monthly attestation reports confirming full reserve backing. For issuers with over $50 billion in outstanding stablecoins, annual financial statements must also be audited by PCAOB-registered firms. These strict regulations make unchangeable logging a must-have for corporate treasury teams.

Mitigation of Operational and Insider Risks

Every action should be logged with a user identity, and any system changes must be documented to reduce insider risks. Treasury teams should maintain an up-to-date list of approved addresses and frequently review access permissions. Monitoring "superuser" activities - such as freezing, burning, or transferring assets - is essential to prevent any individual from bypassing established controls. Separating roles like requester, approver, and signer is a key practice for maintaining audit-ready operations.

Ease of Integration with Treasury Operations

Building on automated risk assessments and policy enforcement, this step strengthens the overall operational framework. Treasury platforms can connect on-chain data with accounting systems using reporting APIs. This automation eliminates the need to manually copy blockchain transaction IDs into spreadsheets, reducing human error. A crypto sub-ledger tracks everything - addresses, transactions, and lot-level cost basis - mapping each blockchain movement to an internal request and approval.

Exportable ledger backups give auditors a complete view of business-related records. Time-stamped logs ensure no one can alter records retroactively, and automated reconciliation quickly resolves discrepancies between on-chain data and internal systems. These tools not only simplify monthly financial close processes but also cut down on manual work during regulatory reviews.

6. Automated Reconciliation Controls

Automation of Risk and Compliance Processes

Handling a handful of payouts manually might work, but when the volume scales up to 50 transactions or more, it quickly becomes impractical. Automated reconciliation solves this problem with a two-step matching process. The first step ensures that opening balances, inflows, and outflows align. The second step matches journal entries with on-chain hashes and gas fees.

By syncing ERP records with on-chain settlements in real time, these systems eliminate delays in reconciliation. This is critical because blockchain reorganizations, or "reorgs", can alter balances after a transaction is initiated. Automated systems address this by reopening transactions if block confirmations drop below a predefined threshold (e.g., 6 confirmations for Bitcoin).

Mitigation of Operational and Insider Risks

Automated systems are designed to detect discrepancies that might slip past human reviewers. For example, they separate gas fees from principal transfers to ensure accurate profit and loss tracking. These controls catch and resolve issues early, preventing them from snowballing into significant errors during month-end close.

"If your reconciliation process can't keep pace with on-chain settlement, you haven't solved the problem - you've just moved it from your treasury operations to your accounting team." - Nathan Johnson, Bitwave

Automated segregation of duties adds another layer of protection by enforcing role separation. This means that different individuals handle requesting, approving, and signing transactions, and every action is logged to a specific user. Pre-transaction authorizations, like sanctions checks and Travel Rule data exchanges, are completed before revealing a settlement address or executing a transfer. These automated protocols create a ledger that’s ready for audits and defensible under scrutiny.

Audit-Readiness and Defensibility of Controls

The GENIUS Act, signed into law on July 18, 2025, requires stablecoin issuers to secure monthly independent attestation reports to confirm 1:1 reserve backing. Additionally, starting with fiscal years after December 15, 2024, new FASB standards require crypto assets to be measured at fair value, with changes reflected in net income. Immutable logs document every manual adjustment or valuation change, providing auditors with a clear and defensible trail. A three-way reconciliation process integrates data from on-chain records, custodians, and ERP systems, creating a unified source of truth.

Exportable ledger backups ensure auditors have access to a full view of transactions.

Ease of Integration with Treasury Operations

The automated reconciliation and audit controls mentioned earlier also simplify treasury operations. Native ERP integrations and middleware automate the flow of journal entries, eliminating the need for manual CSV exports and reducing human error. Additionally, a crypto sub-ledger tracks critical details like lot-level cost basis, acquisition dates, and realized gains, feeding this data directly into the general ledger.

"Reconciliation is such a mess. Almost every transaction for a business originates in the ERP, and is then eventually settled in cash at the bank. So you have these two great ledgers with the Grand Canyon running through the middle." - Brett Turner, CEO, Trovata

7. Whitelists and Address Verification

Automation of Risk and Compliance Processes

Whitelists bring compliance checks to the forefront, ensuring that potential issues are intercepted before a transaction even begins. Instead of verifying sanctions compliance after a transaction is settled, treasury teams can prevent illicit transfers from ever reaching the blockchain. This is achieved through APIs that perform sanctions screening and address verification in just milliseconds, seamlessly embedding these checks into automated workflows.

The Transaction Authorization Protocol (TAP) plays a key role here. It allows institutions to exchange Travel Rule data and settlement instructions before broadcasting a transaction. Under FinCEN regulation 31 CFR § 1010.410(f), financial institutions must collect and transmit originator and beneficiary details for transactions of $3,000 or more. By implementing TAP, treasury teams can screen both parties against OFAC SDN lists before revealing settlement addresses or executing transfers. This pre-transaction approach has proven scalable across thousands of institutions, significantly reducing insider risks.

"When implemented pre-transaction, the Travel Rule becomes a prevention control rather than an after-the-fact record-keeping rule." - Notabene

Mitigation of Operational and Insider Risks

Whitelists, also referred to as allowlists, are particularly effective for warm wallets. They limit transfers to pre-approved counterparties, minimizing risks like insider threats or accidental transfers to unauthorized addresses. Dual control mechanisms ensure no single individual can add or use a whitelist address without oversight.

Maintaining a canonical registry of approved wallets, counterparties, and smart contracts is critical. Each entry should include metadata such as chain, address format, and custody model. Adding automated velocity limits and time-locks to whitelists creates an extra layer of defense against compromised keys or insider threats. For token contracts, it's best to programmatically read decimals directly from the smart contract to avoid accounting errors instead of relying on assumptions.

Audit-Readiness and Defensibility of Controls

Address verification processes generate immutable logs that link blockchain settlement addresses to specific individuals, approval events, and business purposes. These logs align perfectly with corporate treasury audit requirements, strengthening the system's defensibility. The inclusion of metadata - like chain, address format, and custody model - adds valuable context for audits, making them more robust. Such logs are crucial for SOC 1/SOC 2-audited environments, providing auditors with the evidence needed to verify digital asset balances. Every approval and signing event should be recorded in these logs to meet SOC reporting standards.

The GENIUS Act, signed into law on July 18, 2025, classifies stablecoin issuers as financial institutions under the Bank Secrecy Act (BSA), requiring them to meet bank-level AML/CFT obligations. The US Treasury has shifted toward "outcome-based supervision", focusing on pre-transaction authorization rates and freeze actions rather than just Suspicious Activity Report (SAR) counts. Keeping a registry of approved addresses and wallets tied to specific counterparties enables precise reconciliation between on-chain data, custodian statements, and internal sub-ledgers.

Ease of Integration with Treasury Operations

Integrating these controls with treasury systems can streamline operations significantly. APIs connect internal systems to sanctions databases, blockchain analytics platforms, and custodial reporting tools. Leveraging open standards like IVMS-101 and TAP ensures smooth interoperability across various systems and jurisdictions. Organizations using programmable controls have reported 100% compliance in transaction authorization and zero unauthorized transactions.

Setting up API integration and security configurations typically takes 4 to 6 weeks. Automated treasury implementations have demonstrated an average 71% cost reduction and a 99% improvement in settlement times. Whitelists are most commonly applied to warm wallets, which handle regular settlements under defined policy caps, while hot wallets use automated velocity limits for added security. Mapping every transaction to an internal request and an approved destination address eliminates reconciliation backlogs, improving both cost efficiency and settlement speed.

8. Access Controls and Security Hardening

Mitigation of Operational and Insider Risks

Strong access management is a cornerstone of preventing risks and staying audit-ready. Access controls serve as the final barrier against both external breaches and insider threats. A key principle here is segregation of duties, which ensures that no single individual or compromised account can execute unauthorized actions, like draining funds, without oversight.

Implementing least-privilege access is essential. This approach limits users to only the permissions they need to perform their roles. For tasks requiring elevated access, grant temporary permissions, log the activity, and ensure the access is automatically revoked afterward. This reduces exposure to potential attacks and limits the damage if credentials are compromised.

Equally important is securing devices used in signing ceremonies. For high-value transactions, these devices should be stripped of unnecessary software, and features like Bluetooth and Wi-Fi should be disabled. Such devices should remain dedicated to critical tasks and not be shared. When cold wallets are involved in multi-person signing ceremonies, the hardware must comply with FIPS 140-3 standards, ensuring cryptographic modules meet federal security benchmarks. These measures, combined with earlier pre-transaction protocols, create a robust defense against unauthorized access.

Audit-Readiness and Defensibility of Controls

To ensure audit readiness, all administrative actions should be logged with a unique user identity using immutable logs. These logs provide a clear chain of custody, showing exactly who initiated, approved, and signed each transaction. This level of detail is crucial for meeting SOC 1 and SOC 2 reporting standards, which focus on both the design and operational effectiveness of controls.

"Record every approval and signing event with immutable logs; align evidence to SOC reporting expectations (design and operating effectiveness of controls)." - BitGo

The GENIUS Act, enacted on July 18, 2025, classifies stablecoin issuers as financial institutions under the Bank Secrecy Act (BSA). This means that having audit-ready access controls isn’t just a recommendation - it’s a legal obligation for compliance with anti-money laundering (AML) and countering the financing of terrorism (CFT) requirements. Regular recovery drills should be conducted to test business continuity plans, including scenarios like lost signing devices or compromised signers, to confirm that controls remain effective under stress.

Ease of Integration with Treasury Operations

These controls can seamlessly integrate into existing treasury workflows using APIs that connect to identity providers, hardware security modules, and compliance databases. Incorporate tools like SSO, SCIM, MFA, and hardware security keys into the signing process. Automated safeguards, including allowlists, time-locks, and velocity limits, add layers of security that operate in milliseconds. This ensures the rapid settlement speed of stablecoins is maintained while preventing unauthorized transfers. By aligning security with automation, these measures enhance treasury operations without compromising efficiency or safety.

Conclusion

The eight controls outlined in this article shift stablecoin treasury management from a reactive approach to a proactive one. By enforcing pre-settlement authorization, these controls ensure compliance and mitigate risks before transactions are executed. This makes pre-transaction authorization an essential component of stablecoin operations.

These measures, as discussed earlier, create a comprehensive, audit-ready framework. They bridge the gap between periodic attestations and continuous, verifiable proof of effective internal controls. Automated reconciliation and immutable logging are key elements of this system, meeting both auditor expectations and GENIUS Act requirements. The GENIUS Act treats stablecoin issuers as financial institutions under the Bank Secrecy Act, mandating segregated, bankruptcy-remote accounts for reserves.

Platforms like Stablerail make these controls accessible by combining MPC-secured self-custodial vaults with policy-as-code enforcement and AI-driven risk assessments. This integration ties together policy enforcement, risk management, and vault security - central themes of this article. Its API-based design works seamlessly with existing ERP systems, enabling three-way reconciliation between on-chain data, custodian statements, and internal sub-ledgers. This approach not only ensures compliance but also enhances operational efficiency.

With these controls in place, treasury operations can achieve both compliance and scalability. Stablecoins are projected to handle $14 trillion in transactions during 2024, exceeding Visa's total payment volume. To support this growth, treasury teams need infrastructure that scales effectively. Automated controls reduce manual errors, enforce segregation of duties, and provide immutable audit trails, simplifying audits. These capabilities allow CFOs to expand stablecoin usage while maintaining the governance standards expected by boards and auditors.

As 39% of CFOs at companies generating $10 million or more in revenue plan to accept stablecoin payments by 2027, having audit-ready controls is no longer optional. With increasing federal oversight, growing institutional adoption, and rising transaction volumes, treasury teams must implement these controls now to stay compliant, secure, and prepared for the next phase of digital asset integration.

FAQs

What is the GENIUS Act, and how does it impact stablecoin issuers?

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), signed into law on July 18, 2025, lays out the first-ever regulatory framework for U.S. payment stablecoins. These digital assets are pegged to a fixed $1 value and backed by high-quality liquid assets like cash, insured deposits, or short-term Treasury bills, making them reliable for payments and settlements.

Under the Act, stablecoin issuers must meet several key requirements:

Reserve backing: Issuers are required to maintain $1 in reserves for every $1 in stablecoins they issue. These reserves can only consist of specific liquid assets.

Regulatory oversight: Federal and state regulators will oversee issuers, enforcing rules tailored to ensure proper capital, liquidity, and risk management practices.

Transparency: Issuers must clearly outline redemption procedures, release reports on reserves and outstanding stablecoins, and, for issuance exceeding $50 billion, provide audited financial statements.

This framework is designed to safeguard consumers, ensure stablecoins are fully backed, and establish clear rules for issuers. At the same time, it allows issuers the flexibility to operate independently or collaborate with banks.

How do MPC-secured vaults improve the security of stablecoin transactions?

MPC-secured vaults, short for Multi-Party Computation, take security to the next level by splitting cryptographic key management among several parties. This approach eliminates a single point of failure, making unauthorized access or key breaches extremely unlikely.

By dividing key responsibilities and requiring multiple approvals, MPC-secured vaults help mitigate risks such as insider threats, fraud, or accidental mistakes. This setup strengthens the stability and reliability of stablecoin operations while ensuring they meet audit and compliance standards.

Why are automated reconciliation controls important for managing stablecoins?

Automated reconciliation controls play a critical role in managing stablecoins, ensuring that on-chain transactions, off-chain custodian records, and your company’s internal ledger are consistently aligned. By automating this process, every token movement is recorded with unchangeable data, making it simpler to confirm ownership, assess valuation (per ASC 820 fair-value rules), and maintain compliance during audits or financial close procedures.

Relying on manual reconciliation introduces risks like human error, delays in reporting, and potential discrepancies that could lead to audit challenges or regulatory consequences. In contrast, automated systems offer real-time monitoring, instantly flagging irregularities such as unexpected transfers or staking rewards. This proactive approach minimizes operational risks while keeping your stablecoin operations transparent, prepared for audits, and resilient.

Related Blog Posts

Ready to modernize your treasury security?

Latest posts

Explore more product news and best practices for using Stablerail.