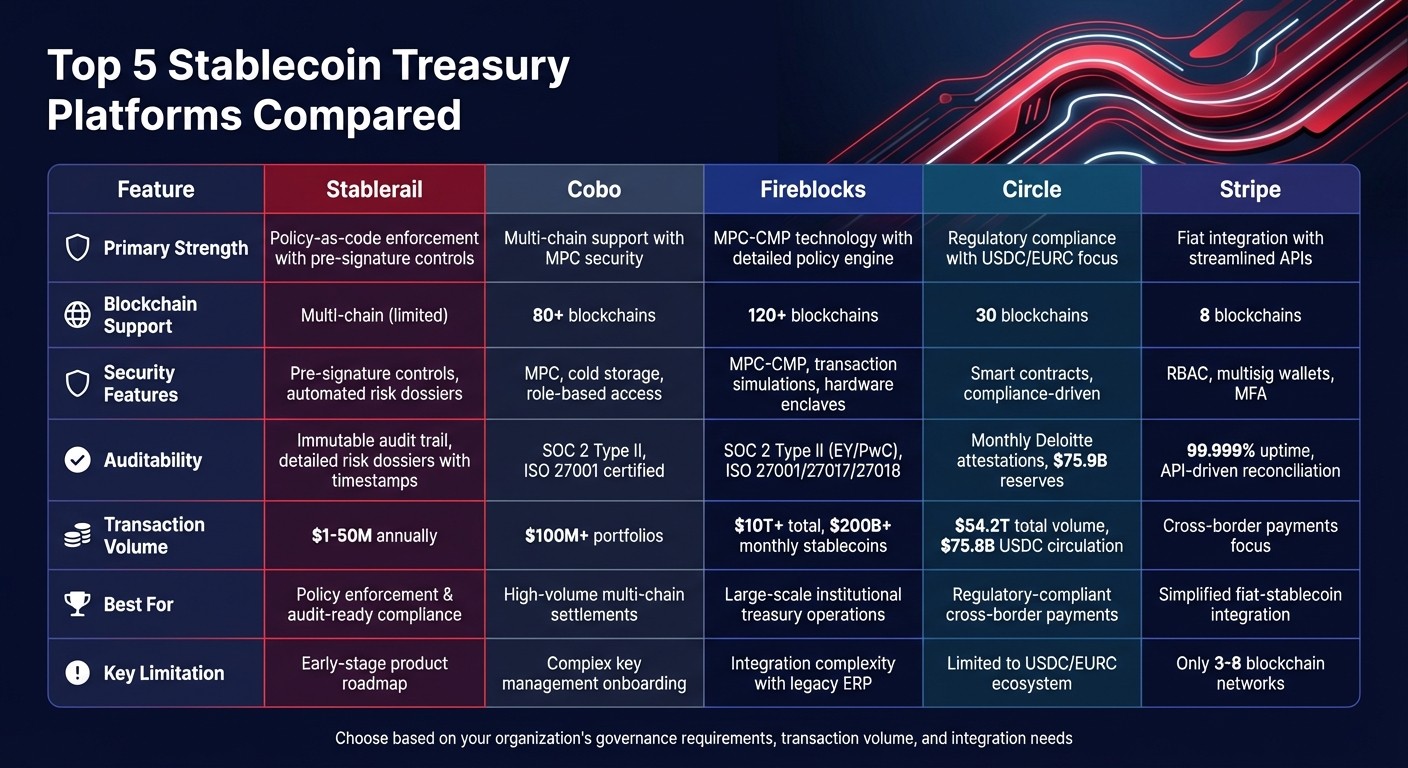

Enterprise finance teams are increasingly turning to stablecoins for faster, cost-effective transactions. However, managing stablecoin treasuries requires specialized platforms and adherence to governance best practices to address governance, security, compliance, and scalability challenges. This article reviews five key platforms - Stablerail, Cobo, Fireblocks, Circle, and Stripe - focusing on their governance frameworks, pre-signature controls, blockchain support, and auditability.

Key Highlights:

Stablerail: Focuses on policy enforcement with pre-signature controls and audit-ready logs.

Cobo: Offers multi-chain support (80+ blockchains) with MPC and cold storage security features.

Fireblocks: Known for its MPC-CMP technology and detailed policy engine for secure operations.

Circle: Provides regulatory-compliant infrastructure, focusing on USDC and EURC stability.

Stripe: Simplifies stablecoin management with fiat integration and streamlined APIs.

Quick Comparison:

Platform | Governance & Security | Blockchain Support | Auditability Features | Scalability Focus |

|---|---|---|---|---|

Stablerail | Pre-signature controls, policy-as-code | Multi-chain (limited) | Detailed risk dossiers, logs | Early-stage product roadmap |

Cobo | MPC, cold storage, role-based access | 80+ blockchains | SOC 2, ISO 27001 certified | High-volume settlements |

Fireblocks | MPC-CMP, transaction simulations | 120+ blockchains | SOC 2, ISO certifications | Large-scale treasury ops |

Circle | Compliance-driven, smart contracts | 30 blockchains (USDC/EURC) | Monthly attestations by Deloitte | Cross-border payments |

Stripe | RBAC, fraud detection | 8 blockchains | API-driven reconciliation | Global stablecoin support |

Each platform has strengths tailored to specific business needs. For example, Fireblocks excels in security and scalability, while Circle prioritizes compliance and liquidity. Choose based on your organization's governance requirements, transaction volume, and integration needs.

Comparison of Top 5 Stablecoin Treasury Platforms for Enterprise Finance Teams

1. Stablerail

Governance Frameworks

Stablerail functions as an automated control layer that sits above custody infrastructure, ensuring governance protocols are followed before any transaction is signed. It uses a policy-as-code engine to convert corporate treasury policies into machine-enforceable rules. For instance, finance teams can set rules like requiring CFO approval for transfers exceeding $5,000, which are automatically applied to all payment intents. This setup reinforces segregation of duties and internal controls, reducing the risk of fraud and errors by preventing a single individual from initiating and approving high-value transactions.

The platform also integrates role-based access controls with multi-step approval workflows, mimicking the governance processes used in traditional bank wire transfers. Unlike solutions that focus only on key management, Stablerail incorporates business context by linking each transaction to relevant documents, such as invoice PDFs or payout CSVs. Its programmable interoperability layer ensures compliance across multiple blockchains, whether the payment involves USDC on Ethereum or USDT on another chain. By enforcing rigorous pre-signature checks, Stablerail strengthens transaction security while maintaining consistent policy enforcement.

Pre-Signature Controls

Before any payment is executed, it undergoes mandatory pre-sign verification. Stablerail's agents carry out comprehensive checks, including sanctions screening, taint and exposure analysis, enforcement of policy limits, anomaly detection for unusual transaction patterns, and counterparty risk scoring. Each transaction generates a detailed Risk Dossier that provides a verdict - PASS, FLAG, or BLOCK - along with plain-English explanations referencing specific policy clauses and timestamps.

When a user submits a payment intent, it is subjected to risk assessment and multi-step approval processes before execution through MPC-based wallets. Importantly, Stablerail does not hold unilateral signing authority and cannot initiate transfers. Funds remain under the company’s control, leveraging self-custodial infrastructure for enhanced security.

Auditability

Stablerail maintains an immutable audit trail for every step in a payment's lifecycle. This includes everything from the creation of a payment intent and risk checks to flags raised, approvals granted, overrides applied, and the final signing. These records provide CFO-grade evidence that finance teams can present to auditors, boards, and regulators. The platform also offers automated reconciliation and real-time visibility, reducing manual workload and minimizing errors in financial operations. Detailed transaction logs - complete with timestamps, user identities, triggered policy rules, and supporting documentation - generate audit-ready reports tailored for both internal controls and external audits.

Enterprise Scalability

Stablerail is designed to grow alongside businesses, accommodating organizations that manage $1–50 million in stablecoins annually. It includes enterprise-grade security measures such as SSO, SCIM provisioning, MFA, and hardware key support, meeting stringent security requirements. The Treasury Hub module provides a centralized view across multiple legal entities, blockchain networks, and stablecoin types. Additionally, the Policy Console simplifies the management of roles, limits, and approval hierarchies. Upcoming modules for payroll, recurring payments, accounting exports, and SOX compliance will further integrate Stablerail into a company’s broader treasury operations, making it a comprehensive solution for financial management.

2. Cobo

Governance Frameworks

Cobo combines MPC (Multi-Party Computation) and cold storage to eliminate single points of failure. By implementing detailed role-based access controls, the platform assigns permissions based on hierarchy, ensuring that no single individual can authorize transactions independently. Instead, quorum-based approvals are required, meaning predefined thresholds must be met before any transfer is authorized. This approach enforces a clear segregation of duties, particularly when it comes to cold storage, where hardware isolation adds an extra layer of security.

Cobo's policy engine allows organizations to create custom rules, such as setting transaction limits, whitelisting wallet addresses, and automating approval workflows. To further enhance security, real-time anomaly detection monitors user behavior to flag suspicious activities before transactions are finalized. Additionally, Cobo holds SOC 2 Type II and ISO 27001 certifications, ensuring it meets global standards for asset protection and internal governance. These measures are key to maintaining the platform's rigorous pre-signature controls.

Pre-Signature Controls

Before a transaction is processed, Cobo's policy engine enforces organization-specific rules through automated checks. Finance teams rely on maker-checker workflows, which require approvals via threshold signatures. The MPC framework ensures that private keys are never fully reconstructed in one location. Transactions only proceed once the required quorum of approvals is achieved, safeguarding the process with threshold signatures.

For operational hot wallets, Cobo applies signing limits, rate controls, and behavioral heuristics automatically. When it comes to cold storage, transactions require multi-party quorum controls alongside hardware isolation for securing core reserves. This hybrid model strikes a balance between operational efficiency and security. High-frequency payments are routed through hot wallets for speed, while larger reserves remain protected in cold storage.

Blockchain and Stablecoin Support

Cobo extends its governance and security measures to support over 80 blockchain networks and access to more than 3,000 tokens. This broad coverage enables finance teams to reduce cross-border settlement costs significantly by routing transactions through low-fee chains. Instead of paying the typical $25–$50 in SWIFT fees, costs can drop to under $1.

The platform's Wallet-as-a-Service (WaaS) and Payment APIs integrate seamlessly with ERP systems like SAP, Oracle, and NetSuite, enabling automated reconciliation. Designed for institutional teams managing portfolios exceeding $100 million, Cobo's multi-chain support also enhances liquidity management. For example, teams can use high-speed chains like Solana to complete settlements in about 6 seconds - drastically faster than the 1–3 business days required for traditional wire transfers.

3. Fireblocks

Governance Frameworks

Fireblocks uses MPC-CMP (Multi-Party Computation) technology to tackle single points of failure in key management. Its Policy Engine allows finance teams to set detailed controls, such as transaction limits, user permissions, and multi-user approvals. These rules are securely stored and executed within a hardware enclave, adding an extra layer of protection against potential threats.

The platform boasts certifications like SOC 2 Type II (audited by EY and PwC) and SOC 1 Type I (audited by KPMG), along with compliance with ISO standards 27001, 27017, 27018, and 22301. Fireblocks has facilitated over $10 trillion in digital asset transfers for institutional clients, processing more than $200 billion in stablecoin transactions every month. This focus on high-level governance aligns perfectly with the need for institutional-grade controls in stablecoin treasury operations.

Jason Guthrie, Head of Product at Fireblocks, highlighted: "Fireblocks wins on scalability, usability, and control through transaction policies."

Pre-Signature Controls

Fireblocks builds on its governance strengths by thoroughly verifying every transaction before execution. The platform simulates transactions in advance to identify threats like malicious smart contracts or spoofing attempts. Its Policy Engine enforces organization-specific rules, requiring predefined approval quorums based on wallet, asset, or transaction type. Additionally, automated compliance checks for AML, KYT, and OFAC sanctions are integrated into the process to detect and halt non-compliant transfers.

DV Chain, an institutional market maker, adopted Fireblocks' Treasury Management system in 2024/2025 to enable faster settlements with customizable governance policies.

Michael Rabkin, Head of Global Business Development at DV Chain, explained: "With Fireblocks, it actually allows us to empower certain traders or certain people on a team to be able to go in and approve those transactions without having only one or two people do it."

This setup has boosted capital efficiency while maintaining strong security measures.

Blockchain and Stablecoin Support

Fireblocks supports more than 120 blockchain networks and thousands of digital assets, including major stablecoins like USDC, USDT, and PYUSD. Through its Fireblocks Network, users gain direct, authenticated access to over 1,000 institutional counterparties and 30+ exchanges, minimizing manual errors during settlement.

For example, Bridge reduced its bulk settlement times from over 12 hours to just under 90 minutes, enabling it to handle millions of transactions. Fireblocks also secures more than 550 million wallets and powers over 240 payment companies, collectively serving around 1 billion end users.

Enterprise Scalability

Fireblocks' automation tools simplify repetitive treasury tasks - like account top-ups, liquidity rebalancing, and scheduled payouts - while maintaining strict policy enforcement. The platform has achieved a NIST CSF 2.0 maturity score of 4.4 and facilitates approximately 15% of all top blockchain transaction volumes.

Zeebu, for instance, processed $5.7 billion in telecom payments and automated over 30,000 operations within just two months using Fireblocks' tools. The platform also provides a unified dashboard for real-time asset tracking across teams, featuring audit-ready reporting and APIs that integrate seamlessly with ERP systems for automated reconciliation. These features make Fireblocks a key player in creating a secure and efficient stablecoin treasury system.

4. Circle

Governance Frameworks

Circle places a strong emphasis on regulatory compliance, operating as the issuer of USDC and setting payment standards. The Circle Payments Network (CPN) functions as a permissioned blockchain network where every participant is a vetted financial institution. Circle oversees network policies, sets operational standards, and ensures participants comply with AML (Anti-Money Laundering), CFT (Countering the Financing of Terrorism), and sanctions regulations.

Circle holds 55 regulatory licenses worldwide, including money transmitter licenses in 46 U.S. states and a Major Payment Institution License from the Monetary Authority of Singapore. Its compliance framework aligns with the GENIUS Act and the EU's Markets in Crypto-Assets (MiCA) regulation. As of January 5, 2026, Circle manages $75.8 billion in USDC circulation, fully backed by $75.9 billion in reserves held at BNY Mellon and managed by BlackRock.

"Through USDC, Circle delivers the deep liquidity, cross-chain connectivity, and enterprise-grade reliability that banks require to bring their stablecoin strategies to life", said Kash Razzaghi, Chief Commercial Officer at Circle.

Pre-Signature Controls

Circle strengthens its regulatory framework with robust pre-signature controls. Through Circle Mint, enterprise teams gain granular permissions with maker-checker oversight, ensuring no single individual has unilateral control over financial transactions. Administrators can create specific user policies for business accounts and delegate tasks using multi-user approvals. Additionally, the Circle Authenticator App provides a second layer of verification before any transaction is executed.

For high-volume operations, Circle's APIs allow treasury teams to integrate stablecoin workflows directly into existing ERP systems, ensuring automated policy enforcement. The platform also offers a Contracts developer service, enabling businesses to use customizable smart contract templates for workflow approvals and tokenization. All participants in the Circle Payments Network must meet stringent cybersecurity and operational control standards before joining.

Auditability

Circle ensures that USDC is 100% reserve-backed with highly liquid cash and cash-equivalent assets. These reserves undergo monthly attestations conducted by Deloitte & Touche LLP. This provides institutions with audit-ready documentation to meet compliance requirements.

The scale of Circle’s operations is evident, with over $54.2 trillion in transaction volume processed as of January 5, 2026. The network now serves more than 600 million users globally as of June 30, 2025, with settlement speeds of less than one second on major blockchains.

Blockchain and Stablecoin Support

Circle issues USDC across 30 blockchains, including Ethereum, Solana, Arbitrum, Base, Polygon PoS, and Avalanche. The platform also supports EURC and provides access to third-party stablecoins through its StableFX engine, covering currencies like AUDF (AUD), BRLA (BRL), JPYC (JPY), KRW1 (KRW), MXNB (MXN), PHPC (PHP), QCAD (CAD), and ZARU (ZAR).

Its Cross-Chain Transfer Protocol (CCTP) enables USDC to move seamlessly between supported blockchains without relying on traditional bridges, reducing liquidity fragmentation. For example, Acctual, a business payments platform, used USDC to process over $25 million in invoices across more than 100 countries by late 2025, offering fast and low-cost solutions. Circle Mint is available at no cost for qualifying institutional customers, offering 1:1 redemption for USD and EUR without third-party risks.

Enterprise Scalability

Circle Mint is designed to provide institutional-grade liquidity, enabling near-instant issuance and redemption of USDC and EURC at scale across 185 countries. With REST APIs and SDKs, businesses can automate mass payouts, treasury flows, and reconciliations. Between September 2024 and September 2025, USDC saw a 108% growth in adoption, underscoring its appeal to enterprises.

"At Alfred, we are excited to be an early partner of Circle Payments network and connect to real-time global settlement rails powered by stablecoins. We see this as a transformative technology for how we move money", said Diego Yanez, Founder and CEO of Alfred.

Circle's infrastructure supports 24/7/365 settlement, eliminating the delays and prefunding requirements associated with traditional T+1 systems. Transaction costs are extremely low on major blockchains like Solana, Arbitrum, and Base, making them a cost-effective alternative to traditional SWIFT or correspondent banking fees.

5. Stripe

Governance Frameworks

Stripe, through its subsidiary Bridge, offers a flexible compliance framework for its stablecoin infrastructure. This system is built on a modular, API-driven design that includes automated identity verification, KYC checks, and sanctions screening. These tools ensure that all participants meet regulatory standards before any transaction is processed, sparing finance teams from the hassle of creating custom compliance workflows from scratch.

Bridge plays a key role as the custodian for stablecoin balances, keeping reserves in segregated, bankruptcy-remote accounts at regulated banks. To enhance security, blockchain analytics continuously monitor wallet activity, flagging suspicious patterns. In cases of fraud or legal concerns, tokens can be frozen or restricted.

Stripe keeps pace with evolving regulations like the GENIUS Act and MiCA to ensure its infrastructure stays compliant. It also tracks customer consent, communications, and account activity, generating compliant money transmission receipt URLs for every regulated transaction. These measures strengthen Stripe's internal controls and pre-signature processes.

Pre-Signature Controls

Stripe employs Role-Based Access Control (RBAC) to ensure that only authorized personnel can initiate or approve transactions. For high-stakes operations like minting or burning tokens, multisignature wallets are required, adding an extra layer of oversight by mandating multiple approvals. Time locks are also in place for sensitive administrative actions, creating a delay that allows for review before funds are moved.

Finance teams can set spending limits to mirror traditional corporate banking controls, minimizing the risk of unauthorized large-scale transfers. Additional security measures include multi-factor authentication (MFA) and the use of cold storage to guard against human error and theft. Automated sanctions screening ensures that illicit wallet addresses are flagged or blocked before transactions proceed, maintaining compliance.

Auditability

Stripe's stablecoin, USDB, is fully backed on a 1:1 basis by USD held in cash and money market funds, ensuring liquidity and transparency for enterprise treasury operations. Through its API-driven system, Stripe provides detailed transaction records and receipts, enabling seamless reconciliation with enterprise resource planning (ERP) systems.

Reliability is another hallmark of Stripe's platform, which boasts a historical uptime of 99.999% for payments. This ensures uninterrupted access to audit trails and transaction logs. The growing institutional adoption of stablecoins is evident, with the average supply in circulation increasing from 152.7 billion in 2024 to over 260 billion in 2025. Stripe's audit-ready infrastructure aligns well with its extensive blockchain network capabilities.

Blockchain and Stablecoin Support

Stripe's global stablecoin support enhances its scalability for enterprises. It supports USDC across eight blockchain networks: Arbitrum, Avalanche C-Chain, Base, Ethereum, Optimism, Polygon, Solana, and Stellar. Additionally, it issues its own stablecoins - USDB, USD1, and EUR1 - for the US and EU markets. These stablecoins are supported in over 100 countries, making Stripe a truly global platform.

Stripe Financial Accounts come with US routing numbers and FDIC pass-through insurance, allowing stablecoins to integrate seamlessly with traditional banking features. Businesses can even issue stablecoin-backed physical and virtual cards for streamlined spend management across international markets. Interestingly, customers paying with stablecoins are twice as likely to be new buyers compared to those using other payment methods. Moreover, companies processing over $1 million in monthly cross-border payments are 92% more likely to rely on stablecoins than smaller businesses.

Enterprise Scalability

Stripe simplifies stablecoin payments by settling them directly into fiat, eliminating the need for businesses to manage blockchain operations themselves. Enterprises can automate recurring transfers from payment balances to financial accounts on a daily, weekly, or monthly basis, optimizing cash flow. APIs further enhance efficiency by integrating automated payouts, treasury flows, and reconciliations seamlessly into existing systems.

The platform's programmable money feature allows businesses to automate complex financial workflows. This includes conditional payouts, revenue splits, and escrow releases based on predefined triggers. With availability in over 100 countries, Stripe delivers the reliability and scale needed for enterprise-level treasury operations.

How Portal Infrastructure Unlocks Enterprise Stablecoin Adoption | Raj CEO Portal | Stable Spotlight

Strengths and Weaknesses

Let’s break down the core advantages and challenges of each platform based on their operational features. Each solution offers distinct benefits, but also requires trade-offs that enterprise finance teams need to navigate.

Fireblocks stands out for its institutional-grade security, leveraging patented MPC-CMP technology. Its Policy Engine allows for highly detailed control over transaction limits and approval workflows, making it ideal for complex governance needs. That said, its extensive feature set can make integration with older ERP systems a bit tricky.

Cobo is tailored for high-volume settlements, supporting over 80 blockchains and more than 3,000 tokens through its Wallet-as-a-Service infrastructure. Its Payment APIs seamlessly integrate with existing treasury systems, simplifying reconciliation processes. However, teams unfamiliar with private key management may find onboarding challenging.

Circle integrates crypto compliance into its operations by embedding AML and Travel Rule logic into cross-chain workflows. With USDC and EURC transactions settling in about six seconds on Solana, it’s a great fit for latency-sensitive workflows. While third-party reserve attestations ensure strong auditability, its focus on native stablecoins like USDC and EURC limits support for a broader range of tokens.

Stripe eliminates the hassle of blockchain management by settling stablecoin payments directly into fiat . With 99.999% historical uptime and availability in over 100 countries, it’s a reliable choice for scaling global operations . However, its blockchain support is limited to just three networks, which may not meet the needs of firms seeking broader chain coverage compared to competitors like Fireblocks, which supports over 120 networks .

These comparisons highlight the delicate balance between governance capabilities and operational simplicity. The table below offers a clear snapshot of how each platform aligns with core treasury requirements:

Platform | Governance Strength | Control Weakness | Auditability Strength | Scalability Limitation |

|---|---|---|---|---|

Stablerail | Policy-as-code with AI copilot verification | Requires MPC wallet setup | Full audit trail with plain-English narratives | Early-stage product roadmap |

Cobo | MPC and cold storage capabilities | Operational challenges with key management | SOC 2 and ISO 27001 certification | 80+ chains with reconciliation gaps |

Fireblocks | Granular Policy Engine with transaction simulation | Integration complexity with legacy ERP systems | SOC 2 Type II, ISO 27001, with real-time visibility | - |

Circle | Smart contract automation with embedded compliance | Limited multi-token support | Monthly reserve attestations and on-chain logging | Focus on USDC/EURC native rails |

Stripe | Standardized merchant controls | - | Public company compliance and 99.999% uptime | Only 3 blockchains vs. competitors' 80–120+ |

Conclusion

From our analysis, it's clear that no single platform dominates every aspect of digital asset management. Take Fireblocks, for instance - it supports over 120 blockchains and features a detailed Policy Engine that allows finance teams to set transaction thresholds and approval workflows. Its MPC-CMP architecture has facilitated over $10 trillion in institutional transfers.

When choosing a platform, begin by defining your governance needs. Implement strict maker-checker rules, spending limits, and authorized signers through a board-approved policy before evaluating vendors. Test the waters by piloting low-risk transaction flows to assess reconciliation and settlement speeds. Ensure the platform offers audit-ready logs for every permission change and transaction.

For businesses seeking full control over keys and context-aware verification, platforms that enforce pre-signature policies strike a strong balance between efficiency and governance. These integrated controls enable finance teams to enhance operations while mitigating risks effectively.

This level of oversight elevates platforms from basic treasury tools to robust enterprise-grade solutions.

FAQs

What governance features does Stablerail offer to enterprise finance teams?

Stablerail offers a suite of governance tools aimed at boosting security and simplifying treasury management for enterprise finance teams. These tools include structured decision-making frameworks, pre-transaction approval mechanisms, and safeguards to ensure adherence to internal policies.

The platform also emphasizes auditability by providing comprehensive transaction logs and reporting features. This ensures transparency and accountability, addressing the specific demands of managing stablecoin transactions on a large scale. With these features, finance teams can handle operations with greater security and efficiency.

How does Fireblocks ensure secure and compliant stablecoin transactions?

Fireblocks secures transactions using a multi-layered security system that combines patented key management, secure hardware enclaves, and proactive threat detection. These features work together to protect digital assets and block unauthorized access effectively.

For compliance, Fireblocks incorporates granular policy controls that manage transaction limits, user permissions, and approval workflows. It also supports essential compliance protocols like KYC, the Travel Rule, and on-chain monitoring. These tools give enterprise finance teams the resources they need to operate securely while meeting regulatory demands.

Why is Circle's stablecoin infrastructure ideal for cross-border payments?

Circle’s stablecoin infrastructure is designed to power real-time, global transactions through its fully reserved USDC token and around-the-clock settlement capability. With support for cross-border payments in more than 185 countries, it offers processing times of less than a second and keeps transaction costs low, making it an efficient choice for international transfers.

What sets Circle apart is its commitment to compliance and governance. By ensuring secure and transparent operations, it provides businesses with a dependable way to simplify international payments without compromising on regulatory requirements.

Related Blog Posts

Ready to modernize your treasury security?

Latest posts

Explore more product news and best practices for using Stablerail.